A Web3 Gaming Case Study In Due Diligence: Wilder World

The best way to position yourself in the Wilder World ecosystem - a guest post by TomXP

This is a guest post by TomXP, make sure to follow him and @GamesLabxyz on Twitter.

Everything in this article is the opinion of TomXP and does not constitute financial advice.

Reach out to Tom on Twitter if you’re interested in a demo for GamesLab Analytics.

1. Introduction: Navigating the Web3 Gaming Space

The web3 gaming space has become increasingly noisy, making it challenging to discern which projects offer a competitive edge and the best investment opportunities for success. Having closely monitored Wilder World and the broader web3 gaming market for several years, I am well-equipped to evaluate the investment potential of Wilder World within the larger industry landscape. With the release of their first playable experience, the feedback has already been very positive, including comments such as the following from unbiased thought leaders within the space.

The smartest money will always carry out the deep due diligence of a project. This case study of analysis also aims to demonstrate insights into how you can approach prolonged due diligence of other web3 projects that interest you.

2. Overview of Wilder World: Redefining Gaming for the Future

Wilder World, led by co-founders ‘n3o’ and ‘Frank Wilder’, is taking a unique approach to game development, riding the crest of the exponential technology curve with innovative tech utilization.

The project’s ambition surpasses that of most web3 ventures, boasting a virtual world of unprecedented scale based on photo realism, exceeding the size of the GTA 5 map by 13 times. People might say this is crazy and it’s just a pipedream, however, they would be wrong. ‘Wiami’ as named by the project is already a reality and the team has already completed building an area larger than the GTA map.

This achievement is attributed to Wilder World’s leadership in AI and procedural generation systems within the gaming space.

While it’s impossible to cover every aspect of the project in this article, after extensive research into their latest updates, I’ve identified the key elements of Wilder World’s progress. In this article, I’ll highlight these crucial aspects and discuss their potential impact on the project’s future success.

Investing in Wilder World may seem like a high-risk proposition given the scale of its aspirations, but it also offers the potential for substantial returns mid and long-term.

3. The Three Layers of Wilder World: A Deep Dive

To understand the true extent of what has been built by the team there are 3 key Layers to be aware of:

1- Zero, the infrastructure layer (In development for 10 years)

2- Wilder World the Simulation game + Virtual Nation (In development for 4 Years)

3- Meowchain -Native ‘Gasless’ L2 Chain

At present, there are tokens for Zero (MEOW ticker) and Wilder World (WILD ticker).

Zero — The Infrastructure Layer

Understanding the backstory of Zero’s development clarifies the genesis of Wilder World. Initially, the team attempted to sell the early Zero tech in 2015 but encountered no interest. Undeterred, they recognized the need to demonstrate its potential through a tangible use case, leading to the creation of Wilder World. This situation echoed a similar challenge faced by Pixar in the past. Despite struggling to sell their animation tech to Disney and DreamWorks due to a lack of perceived demand, Pixar found a solution in creating the Toy Story movie. This served as a showcase for their technology and proved its concept, ultimately shaping the future of animation.

In this analogy, Zero represents Pixar, and Wilder World represents Toy Story.

ZERO is built using five core interoperable systems:

ZNS: A smart contract protocol that enables decentralized global unique identity, indexing, and routing.

ZBI: A system for redistributing net revenue to network stakeholders, including Citizens and node operators.

ZXP: A smart contract protocol for designing a novel game, reputation, governance, and incentive landscapes.

ZDAO: A smart contract protocol for launching, managing, and participating in a network of DAOs.

ZODE: A distributed network protocol for incentivizing the operation of ZERO computing services.

All these infrastructure pillars are the foundation of Wilder World. Most Games aren’t building or even thinking at this level of depth.

In the future, the key thing is Zero gives the infrastructure for other builders to come in and build their own ‘Wilder World’ experience out of the box.

Wilder World — The Simulation

The Wilder World game experience is described by them as followers:

Wilder World aims to create more than just a virtual environment. Our vision is to create the ultimate game. To combine leading game genres into a single immersive experience like no other. Typically, action RPGs like GTA and Cyberpunk create a great experience, but relative to focused genres, certain elements fall short. Driving is not as good in open worlds as in racing games. Combat is not as robust as it is in combat games. Generally immersive story driven games lack high quality online modes relative to MMOs or do not have them at all.

Wilder World will have 4 defining game modes:

Racing: A next-gen racing game focused on casual and competitive sim racing (similar to NFS, Forza, iRacing or Assetto Corsa).

Mining: A next-gen RTS and simulation game (similar to Age of Empires or SimCity).

Combat: A next-gen FPS and third-person combat game (similar to Halo or Fortnite).

RPG: A next-gen MMORPG that combines all game modes (similar to World of Warcraft).

The 1st playable experience is ‘Racing’ and this is live now to an early cohort of players. The feedback has been very positive from everyone including unbiased key opinion leaders in the web3 space.

Meowchain

A Layer 2 gasless blockchain built by Wilder World to carry out all transactions within their metaverse.

4. Strategic Decisions Driving Success:

When investing, I look for evidence of smart strategic decisions in action. Wilder World’s approach stands out as they’ve made bold moves that diverged from market trends, proving to be shrewd plays.

Key Strategic Decision 1: Marketing Restraint

Amid the hype of the last bull run, the team resisted the urge to splurge on marketing. Drawing from experience navigating economic downturns, they strategically preserved capital, avoiding wasteful spending on conferences and influencers. Instead, they focused 95% of their efforts on product development during a deep build cycle, resulting in a highly advanced game and infrastructure. This prudent approach positions them to leverage saved funds for sustained marketing efforts over the next 12–18 months.

Key Strategic Decision 2: Team Restructuring

Facing the bear market head-on, the team made tough choices, downsizing to under 100 employees from an initial 150. Despite the reduction, productivity soared, with the team achieving five times the output according to their CEO n3o. This success stems from fostering a strong company culture and recruiting individuals aligned with it. Like Elon Musk’s transformative cuts at Twitter, Wilder World’s leaner workforce achieved remarkable results that can now be seen in the playable game being experienced by the community.

Wilder World's strategic planning ensured a cash runway through the bear market which has negated being forced into raising capital with their backs against the wall. Their prudent management signals strength to investors, positioning them for future funding opportunities amidst market fluctuations.

With a current runway of over two years and potential extension deals on the horizon, their strategic financial management bodes well for future growth.

5. Unveiling the Economy: A Game-Changing Paradigm

In the words of the founder n3o and to put it in its simplest form, for Wilder to World to be a major success, two things must happen:

The Game needs to be good.

The Economy must work.

In a recent AMA, n3o stated the part of the project he is most excited about is the economy and he believes Wilder World will be most remembered for how robust their economy was.

Hearing this statement, delivered with conviction and confidence, certainly caught my attention. When you understand that the team began work on this back in 2017 working alongside the inventors of the bonding curve it highlights how long they have been working on solving a problem that hasn’t been achieved in a video game yet. Eve Online is the one game that has gotten close to achieving a sustainable economy and the team has studied this game for years.

The biggest problem for Eve?

‘They weren’t able to dynamically adjust the number of resources in the world depending on how many people were playing the game’.

This problem meant it either got very expensive for new players or far too cheap. The appearance of this problem has been played out many times in Crypto with early attempts to have a live economy (think Axie and Pegaxy).

How does WW look to rectify this?

They are leveraging a concept called a bonding curve, which describes the relationship between the price and supply of an asset. Essentially, as more people acquire the asset, the price gradually increases. In simple terms, Wilder World will implement a bonding curve mechanism using blockchain technology.

This mechanism establishes a set of rules that provide a starting point for the economy, allowing the market to determine the asset’s true value over time.

The team’s approach to solving the economic challenge is guided by a fundamental belief:

they assume they might be wrong about their model.

By adopting this mindset, they integrate flexible and adaptable systems into the economic model. This strategy allows them to avoid getting stuck in a rigid framework, as the dynamics of achieving a sustainable economy are still not fully understood.

Land

During the last bull cycle, there was significant hype surrounding the value proposition of virtual land. This reached its peak with the land sale for the “The Otherside” metaverse project, which brought in $350 million. However, there has been little evidence of thoughtful planning regarding how this land can sustain and increase its value. This lack of foresight is now evident in the collapse of its floor price and a scaling back of the project’s ambitious vision for a metaverse experience.

Wilder World announced that each of their Land plot NFTs will be backed by a significant amount of WILD tokens from their treasury. This means that Land will always maintain a minimum value tied to the price of WILD tokens, similar to how gold maintains a minimum scrap value based on the current price per gram. However, in practice, the price of land is expected to trade at a ratio higher than the token value due to its utility.

This land model will also benefit the WILD token by taking a significant amount of supply of the market.

At the end of this article, I’ll explain how you can get hold of this ‘free’ airdrop of Land which includes the airdrop of WILD.

The Failure of the NFT Model

The big problem with the NFTs in games to date has been:

Not clear where the relative value was for the NFTs because of no constraints on supply i.e. not tied into any larger economic system.

The royalty’s business model was wiped out.

The key to Wilder World’s NFT generation:

‘There will only be so many NFTs that can be generated in Widler World unless the economy grows’.

Wilder World has created a system with specific rules that create a cap in the same way BTC has a capped supply of 21m. The whole economy will rebalance itself based on supply and demand.

The success of this model would not be possible without blockchain technology, and its success would make the inflated material generation of previous game economies such as World of Warcraft and Eve Online a thing of the past.

If Wilder World achieves the first sustainable game economy the value that could be built into the virtual nation would be groundbreaking. The GDP of the virtual world could surpass many real-life nations. Once Crypto projects become valued based on fundamentals rather than ludicrously hyped speculation, Wilder World would become valued at the top echelons of the market with a direct correlation to revenue.

Resources

The backbone of the economy will be the raw material production. This will create a gamified experience of material mining and then trading of these materials based on supply and demand mechanics linked to the creation of all things from these materials in the Widler World virtual world.

The Process

Capital flows through a single-sided bonding curve:

User deploys WILD token (Energy) > Mining site produces raw materials > Materials sold to open market > Refined into various objects for the world’s use.

Leveraging four years of experience in Unreal Engine, the Widler World team can accurately estimate the materials required for any structure. Whether it’s a 3-storey house or a 10-storey apartment block needing a specific number of bricks or windowpanes, their in-depth understanding enables real-time supply and demand dynamics essential for a sustainable economy.

Commodity Trading in Game

All materials produced in the game will be tradeable on the Meowchain. Gone will be the days of trading meme coins based on pure insanity and speculation, trading of commodities in Wilder World will be based on immutable rules giving smart people a real opportunity to trade and make a living out of trading items that have an underlying economic value. This will be a safer environment to trade in compared to the dangerous environment of shit coin trading when liquidity can disappear in a moment.

6. Partnerships and Technological Advancements: Paving the Way Forward

METAGRAVITY

A critical challenge in realizing the ‘Simulation’ vision is achieving groundbreaking levels of ‘Concurrency,’ allowing 10’s of thousands of players to interact within a single sharded computing environment and eventually millions.

Metagravity is the company at the forefront of solving this problem.

Presently, games face limitations:

Eve Online’s largest battle involved 7k players but in a separate environment from the main game.

Games like Fortnite and World of Warcraft usually support up to 100–150 players per instance.

Wilder World's first goal aims for:

30k avatars in a single shard.

Recent progress includes reaching 12,000 concurrent users in one shard, placing Wilder World in the top 0.1% of games globally for mass Concurrency.

Nvidia- Wilder World is for All

Wilder World faces a challenge in making its cutting-edge experience accessible to the masses due to its high system requirements. To address this, Wilder World has partnered with Nvidia to deliver the game via their Cloud gaming service, GForce. This means players can access Wilder World using any device without the need for high-end hardware, expanding the potential player base significantly. The partnership, years in the making, is already in the integration phase, with Wilder World set to go live on Cloud gaming this year with a free tier service.

7. Seizing the Investment Opportunity: Strategies for Success

The Team’s Macro view — Here lies the opportunity.

A favorite saying of the project’s founders is “Skate to where the puck is going.” Wilder World has always adopted the mindset of building for the future rather than the present, ensuring they stay ahead of the competition when the future arrives.

Although the metaverse mania had its blow-off top, it is not dead and n3o predicts a shift from ‘Gaming’ to the ‘Metaverse’ will happen either later in this cycle or the next cycle.

Many terms will be used by the giants of tech, Facebook with ‘Meta’, Apple using the term ‘spatial computing’, and now Wilder World with the term ‘The Simulation’. N3o sees the convergence of AR, VR, XR, AI, Blockchain, photorealism, mass concurrency, and Cloud Gaming being the kumbaya moment when the vision is fully realized.

The Thesis

At present, if you look at the top 50 coins on CoinGecko you will see it is filled with blockchains. The team’s conviction is there will be a reorganizing of the whole space with these top coins being replaced with DAPPs, platforms, operating systems, games, and Metaverses.

Why?

History has shown in technological revolutions such as the internet, that value moves upstream to the customer-facing applications.

Why will the blockchains become less valued relative to the upstream applications?

The cost of doing transactions on the chain is heading to zero. Most of the tech has been completed to enable fees to go to zero with settlements on Ethereum. Differentiation between Blockchains is getting smaller and smaller. Chains are throwing significant money at games as they need a ‘hit’ from aWilder World that brings millions of players so that chain can scale. Networks relying on fee’s will be commoditized and the sector will consolidate.

‘Commoditize meaning a product or service has become identical to the same type of offering presented by a rival, distinguished only by its price’

Content will become king.

WW and Zero Extremely well-positioned for the next phase of the industry shift

With Wilder World and Zero being front-facing applications they are perfectly set to be in the most valued bucket in terms of business and products. Being upstream also enables Wilder World to have a different business model to cover any network fees, unlike the blockchains.

Momentum Incoming

Wilder World has remained under the radar for an extended period due to their two-year deep build cycle and minimal marketing efforts during the hype of the last bull run. However, this is changing. Over the last 2 years they have secured numerous significant partnerships and are preparing to unveil them alongside substantial product releases. This coordinated cycle of information and product releases, dubbed “dominos,” is set to span 12–18 months.

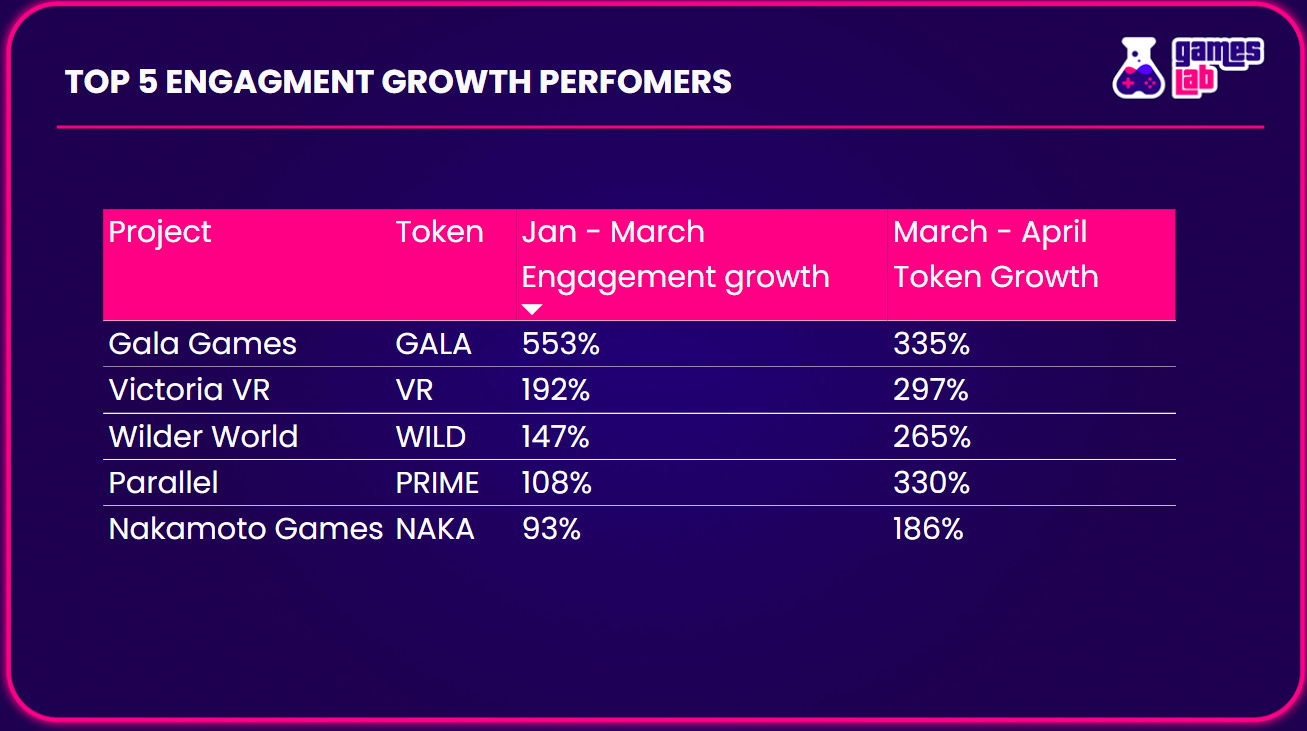

In the crypto investment community, attention drives asset prices in tokens and NFTs, forming the “attention economy” of the space. I have previously proven a direct statistical correlation between Twitter growth and Token price action ((links to analysis below).

With Wilder World’s prolonged marketing activations and rollouts, it’s evident that they are poised to continue building attention momentum in the crypto space, supported by genuine fundamentals. Investing in their ecosystem now, before momentum escalates further, could prove highly lucrative, assuming the market maintains its current trajectory.

To illustrate, picture Wilder World and Zero like a beach ball held underwater for the past two years, now released and bursting to the surface. Timing is crucial in investing, and seizing the right moment is key to finding an edge.

What options do I have to gain exposure?

What exposure options are available?

While many projects have initiated reward distributions, Wilder World has yet to activate theirs. N3o mentioned that they have a substantial amount of WILD and MEOW tokens set aside for rewards (refer to original tokenomics allocation).

The project plans to launch the game on ‘meowchain’ via the Epic Games Store by the end of June, which is when rewards will commence.

These rewards will operate in two systems:

Asset ownership and infrastructure usage: This includes points for activities on Meowchain, using the Zero messenger app, holding WILD or MEOW tokens, and owning Wilder World NFTs.

The Racing Game: Rewards will be based on time and performance spent in the game, with additional bonuses for exploration.

Eventually, the rewards system will transition into a daily participation-based rewards system called ZBI (Zero-based income).

For context, this is the current valuations for Axie Infinity’s L2 blockchain:

Ronin $3.7 billion FDMC

The Meowchain token airdrop is scheduled to occur by the end of the year. (% of supply for airdrop has not been announced yet)

Short term — Token + NFTs

The WILD Token has risen 5X from its bottom price and the MEOW token sits 3X from its low, both are showing early signs of momentum. For context, many other gaming projects have already run 10–20X off their lows. With ongoing marketing efforts set to continue for the next 12–18 months, there’s potential for increased attention from traders and investors. However, this growth relies on a positive macro environment. Unlike many projects that lose attention quickly, Wilder World has a robust pipeline of releases, which could sustain and grow interest over time.

NFT Investments

One trade opportunity involves purchasing three NFTs to receive an airdrop of three lands, each with a significant amount of WILD token attached. The first land drop, expected this year, could present a favorable investment if the market continues its upward trend.

Genesis NFT collections:

Cribs

Crafts

Wolves

Wheels

AirWild season 1

Moto

Cyber heist

At the time of writing, purchasing a trinity costs 0.79 ETH and the main utility is a free airdrop of three lands with WILD tokens, plus a free avatar drop.

Another potential trade involves purchasing a Wilder ‘Gen’ collection NFT. These NFTs contribute to a trinity for ‘Land Drop 2’ and enhance production in the mining game, which launches before the land drop. With Gen’s currently priced at 0.15, this trade could be advantageous before the market fully realizes their utility.

8. Investment Thesis: The Future of Wilder World and Beyond

The overarching investment thesis centers on backing Wilder World, Zero, and Meowchain throughout this bull cycle and into the next cycle, positioning them for long-term success. As the Metaverse reality takes shape, Wilder World and its infrastructure products can be poised to lead the gaming and virtual nations’ landscape. With them being multi years in, they have already proven their staying power.

In this future scenario, token valuations will be aligned with fundamental metrics such as network value, GDP, and revenue. As long as I continue to witness the compounded progress I’ve observed since discovering the project several years ago, I will maintain a long-term position in anticipation of this future reality.

For context, consider Roblox, a gaming ecosystem currently valued at 25 billion based on revenue fundamentals. If Wilder World were to achieve a similar valuation, disregarding inflated crypto valuations, it could represent a potential 100X increase from current levels.

Wilder World’s Competitive Edge

Warren Buffet famously said:

“The most important thing is trying to find a business with a wide and long-lasting moat around it … protecting a terrific economic castle with an honest lord in charge of the castle,”

The “moat” he talks about refers to a competitive advantage that makes the business unique and better than others.

What is Wilder World’s Moat?

Wilder World’s ‘economic castle’ is everything I’ve described above about their economy and their ‘honest lords’ being n3o, Frank Wilder, and the other co-founders who have transparently led the project for several years now.

Delivering the ‘simulation’ is an exceptionally daunting task, requiring the creation of a truly immersive, single-sharded environment. To achieve this, several critical factors come into play:

Building the Economy: Understanding the intricacies of the economy, which has been a core focus since Wilder World’s integration with Unreal Engine in 2020.

Grasping System Constraints: It’s imperative to comprehend the underlying costs within the system to determine true values. This understanding is only achievable through extensive problem-solving and infrastructure development, forming the foundation of Wilder World’s uniqueness.

Understanding Raw Costs: A deep understanding of the raw costs of components is essential for constructing the economy effectively. Wilder World possesses this knowledge, setting them apart in the market.

Over four years spent building within the engine, Wilder World has accumulated invaluable insights, and understandings, and developed intricate systems. This foundational work allows for iterative improvements, leading to exponential progress and compounding advancements.

Wilder World’s confidence in its unmatched position stems from its ability to create an unparalleled experience, characterized by a single-sharded environment with a vast array of objects. This level of complexity makes replication exceedingly challenging. Any attempt to emulate Wilder World’s success would require:

a) Understanding Wilder World’s Approach: Potential competitors must grasp the intricacies of Wilder World’s operations.

b) Years of Development: Replicating Wilder World’s specialized skills and systems would necessitate a significant time investment.

The invaluable lessons learned, and systems developed over the years serve as Wilder World’s protective barrier, ensuring its market dominance.

Distribution

The long-term investment thesis is bolstered by innovative distribution strategies, such as leveraging GForce of cloud gaming, and the expansive total addressable market encompassing users across various devices.

As Wilder World continues to advance, positioning itself at the forefront of the evolving gaming landscape, early investment opportunities will diminish rapidly, underscoring the importance of recognizing its potential early on.

Final thoughts

My belief and conviction lie in placing my largest money allocations in investments that back projects with the strongest fundamentals and true long-term aspirations, where I feel most comfortable and secure. While there may be ample opportunity to profit from hyped projects lacking real fundamentals during a bull run, if you truly believe in the potential of web3 gaming/metaverse to become the juggernaut industry that those with conviction in the space envision, then you will seek exposure to projects capable of eventually executing games and experiences played by millions, supported by business models that can be valued as real businesses. By examining the approach I’ve outlined in this article, you can seek out other projects that are also executing on key verticals, as Wilder World is currently achieving.