The Wolves DAO Files #23: Zynga's Sugartown and Web3 Playbook

Rebooting old Web2 games for Web3 a master plan or a lazy way to 'fool' Web3?

Zynga x Web3

Just over a month ago, Zynga unveiled their Web3 gaming venture called Sugartown, which they had been secretly developing for 18 months. This announcement generated significant excitement within the crypto community on Twitter, fueled by the anticipation that the involvement of a corporation of Zynga's magnitude could greatly accelerate the adoption of Web3 gaming. To provide context, Zynga is a company valued at $9.3 billion and is a subsidiary of Take-Two Interactive, a company with a market capitalization of $23.7 billion.

Here is a snapshot of Zynga's most renowned games:

The majority of gamers primarily associate Zynga with their immensely popular franchise, Farmville, naturally leading to expectations of a sequel or a similar title. However, Sugartown isn't a game; it represents an IP and a platform designed for both gaming experiences and community development. Over the course of several weeks, Zynga's marketing endeavors gradually unveiled the nature of the games that would be featured on this platform, clarifying Zynga's strategy.

Zynga’s Game Plan

Zynga's recent announcement about the games available on their website two weeks ago brought to light that expectations had been set too high. The list of games, as shown in the screenshot below, featured titles that players were already acquainted with, such as Geometry Dash, Mountain Goat, and Zynga Poker.

I think it's a cheap way to do it. They could at least bring relevant games. I like Boomland's approach better since they are bringing their already up-and-winning web2 game (Hunt Royale) to web3.

Their strategy may just fail and from that result, they will deem web3 unworthy of their attention.

Rather than presenting newly developed games, Sugartown will encompass revamped versions of older games that either didn't perform well or were previously discontinued.

Mountain Goat had a 55% D1R (day 1 retention), top 1% for all mobile games, but it didn't monetize to Zynga standards to stay afloat. But since the metrics were good it makes sense they recreated the game with a new leveling system.

Leaderboard System

In addition to Sugartown, there will be a competitive aspect introduced through a leaderboard system. To participate in this feature, players will be required to possess a Sugartown Ora NFT and stake it to accumulate energy, which will be expended during gameplay.

The Sugartown ecosystem will encompass five winning conditions:

Leaderboard Rankings:

Players will earn more points as they accumulate more energy. This system tends to favor players with a larger collection of NFTs, often referred to as "whales."

Raffles:

Prizes will be randomly distributed, with a player's chances of winning tied to their event progression. This appeals to casual players who may not wish to engage extensively but still want a shot at prizes.

Top 3 Highest Levels:

Rewards will be granted to the top-performing players who achieve the highest levels, appealing to competitive gamers.

"Fun Lever":

Certain rewards will be determined by metadata and types, adding an element of variety and fun to the rewards system.

Multi-Leaderboard Function:

Live operations will create opportunities for players to earn rewards through multiple leaderboards, enhancing player engagement and opportunities for prizes.

Hybrid Casual

Sugartown represents an ecosystem of hypercasual games interconnected through a reward system, effectively blending into a hybrid casual gaming experience.

Hybrid Casual = hypercasual (Geometry Dash) + meta loops (LiveOps) + progression (leaderboard rewards) + social (community aspect).

The hybrid casual model is seen as a way to boost player retention and enhance lifetime value (LTV), leveraging the various features outlined earlier. Sugartown appears to serve as a trial ground for Zynga to assess the effectiveness of this model and its potential application to a broader range of their (hyper) casual games.

I think it's because a lot of causal games now have more depth than before. The hot genre right now is "casual core".

Mechanic: casual (like match 3)

Metagame: mid-core (like RPG-like progression)

In 2020, Zynga acquired Rollic, an Istanbul-based developer and publisher renowned for hyper-casual games. This strategic acquisition was noteworthy due to the considerable impact of mobile privacy changes, such as Apple's App Tracking Transparency (ATT), which had a substantial effect on this genre.

Testing the Model

In essence, Zynga's strategy enables them to navigate the Web3 landscape in a cost-effective manner by testing and refining their approach. Repurposing existing games helps keep development costs and resource demands to a minimum, with the possibility of venturing into entirely new game concepts in the future.

Zynga went with a completely free mint, 0 liquidity taken, in an optional royalties market, so their objective seems to be building a base.

This approach stands in contrast to some Web3 gaming studios that aim to create the next big "AAA" titles, often entailing substantial costs and heightened expectations. Zynga's strategy allows for a quicker search for Product-Market Fit (PMF).

Currently, Sugartown's games are exclusively available on PC. If this model proves successful, it's highly likely that the ecosystem will expand to mobile platforms, where casual games thrive. Zynga's use of recognizable Farmville characters enhances the project's brand recognition, a factor that could greatly contribute to its scalability.

Zynga’s thesis seems that they can build the product for web3 natives, craft a rewards loop/infra, and in parallel build out the noncustodial play because the latter is not a small effort that requires a lot of regulation discussions. This allows them to build the native base while building the path to web2 adoption.

Marketing and Communication

Ensuring that expectations align with reality primarily hinges on marketing and communication. Much of the skepticism surrounding Sugartown is related to this issue, as their marketing efforts substantially shaped unrealistic expectations.

Personally, I don't love the existing playbook that a lot of projects used (and some still use), where there's very little information and mostly FOMO/hype-based marketing to push out a mint, with a "trust me" promise that when info is finally revealed it will be good. Imo that brings in mostly speculators, and for games to succeed, they need to find actual gamers who are going to be invested in the gameplay/progression.

Sugartown employed a marketing strategy rooted in mystery, akin to the approach popularized by Yuga Labs. The tactic is designed to leave room for the audience's imagination to fill in the gaps, often resulting in significant overestimations of what will be delivered, thus fueling speculation. Additionally, Zynga's well-established reputation and size played a pivotal role in this process.

As a publicly traded company, Zynga can't actually show a "roadmap" (because Gary G), the idea seemed that they wanted to slowly drip out content/products for fun/excitement.

Targeting Web3 ‘Degens’

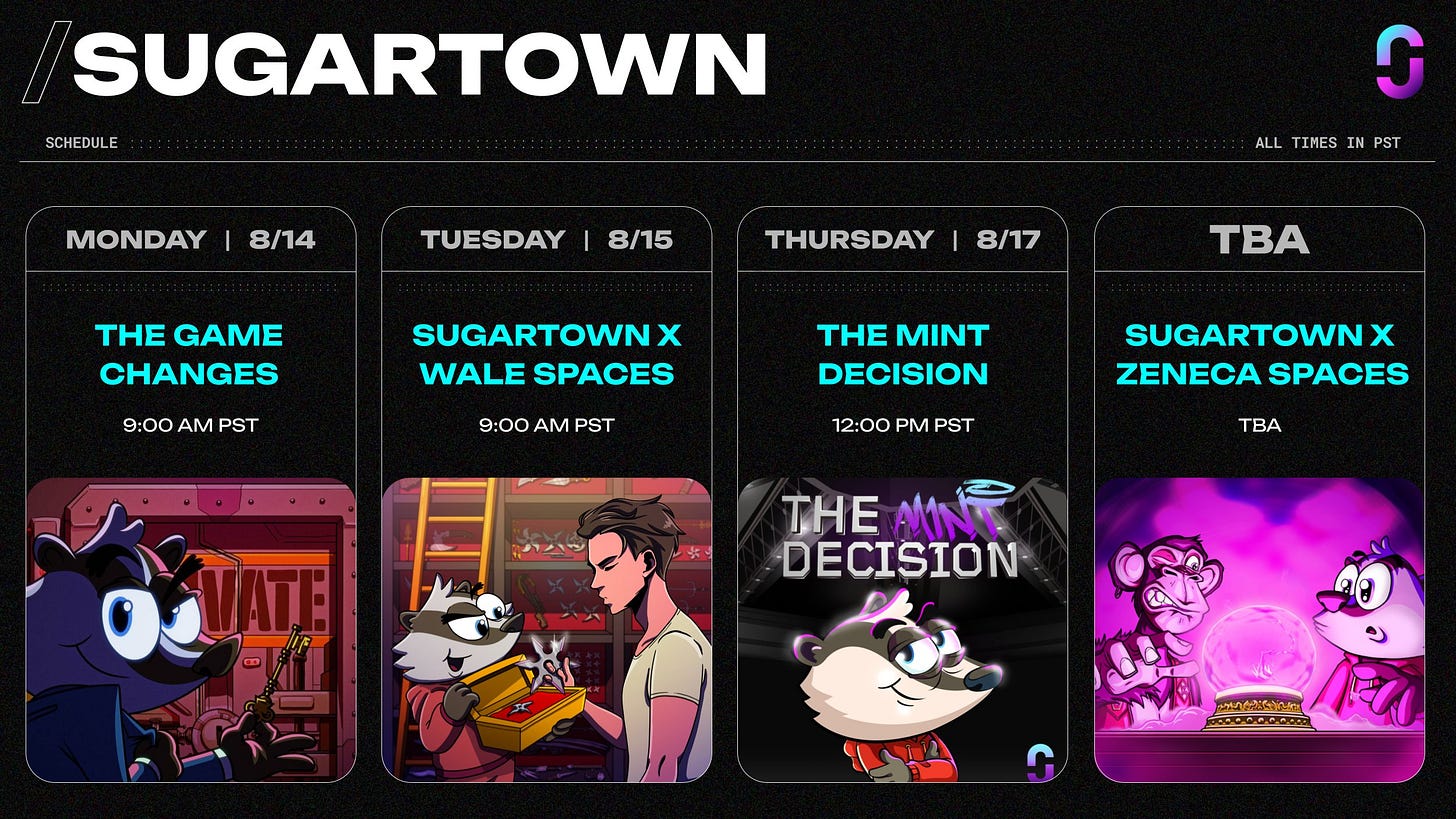

As part of Sugartown's marketing and communication strategy, there was a deliberate emphasis on targeting a Web3 audience. Made evident in their choice to collaborate with prominent figures in the Web3 space, including:

CamolNFT;

Wale.swoosh;

Zeneca;

And Pandez.

History has demonstrated that engaging individuals well-versed in Web3 is crucial for understanding the industry's culture, especially concerning messaging, marketing, distribution, and mint strategy. Exemplified by the numerous failures of Web2 companies attempting to enter this space.

In the following post, Jonah highlights the significance of CamolNFT's role as a product marketing manager for Sugartown. Through his X account, Camol effectively leverages his audience to ensure Sugartown remains prominent within its community of holders. In October alone, he shared and reposted over 50 messages related to the project.

As the Ora Mint launch approached, Sugartown successfully collaborated with Wale.Swoosh, a prominent figure in the broader Web3 sphere. Wale's endorsement of a project has historically wielded significant influence over its potential for success.

Social Media Strategy

Although Sugartown's strategy received criticism from some members, it undeniably proved to be highly effective, as evidenced by:

Achieving a 50,000-strong following.

Generating substantial engagement on their posts.

A highly successful mint event.

Sustained trading volume post-mint.

A collection valued at 0.25E with approximately 3,100E in trading volume over the last month.

This success can be attributed to Zynga's expertise in game marketing, as demonstrated by their ability to engage the audience through captivating videos, GIFs, images, and posts in recent months.

A Paradigm Shift?

The upcoming months hold significant importance for Sugartown, as the team aims to validate the Web3 business model's potential for enhancing the (hyper-)casual gaming genre in areas like user acquisition (UA), retention, engagement, and lifetime value (LTV). If Sugartown fails to demonstrate this potential to Zynga, there's a possibility the project may not survive beyond the next year.

Sugartown constitutes only a small fraction of Zynga, particularly in comparison to Take-Two. The company has more substantial projects in development, such as GTAV1, so reallocating resources could lead to the discontinuation of Sugartown. Additionally, history has shown that major gaming developers and publishers are not hesitant to shelve their Web3 ventures, as seen with Homa Games.

Conversely, if Sugartown proves successful in Zynga's eyes, it could herald a broader shift in the gaming industry. A shift that might not be limited to studios specializing in the casual and related genres but could encompass a larger, Western gaming landscape. Over the past few years, gaming studios (especially mobile ones) have faced challenges in maintaining profitability and margins. The endorsement and involvement of a prestigious developer and publisher like Zynga could encourage more studios to embrace the Web3 space and explore a new business model.

If they do succeed, it can only be good for Web3 and slowly shift the paradigm of how all Web3/NFT/crypto are scams and no serious gamer would ever touch them in a more positive light.

Conclusion

Zynga's entry into Web3 with Sugartown has sparked much interest. While initial expectations leaned toward entirely new games, the project actually repurposes older ones, introducing a hybrid casual gaming model blending hypercasual gameplay with progression and community elements. Sugartown's early success in garnering a sizable following, robust engagement, and a prosperous mint event highlights Zynga's adept game marketing. The project's future hinges on proving the Web3 business model's potential to enhance casual gaming, with success possibly sparking a broader industry shift toward Web3 adoption, while failure might lead to discontinuation, mirroring past Web3 ventures.

Special Thanks To

Noice, Ahri, Junge, TanyoG, Behold3r, Tictacs, Matt, Rich Cabrera, StoicJay, Slayer, Kaizen, Zapdan, Samusb, TomM, Gcrod, Steps, and No1Smurf for actively contributing to the discussion and providing valuable insights.

Need Help?

Need market intel and advice to help your Web3 project succeed? Get in touch with The Wolves today and receive a free consultation!

Disclaimer

None of this is financial or legal advice.