The Wolves DAO Files #30: A Critical Look at Token Launches

Addressing the current token meta, looking at what is currently happening, and predicting what's to come.

Token Token Token...

In November, our article 'The Pros and Cons of Gaming Tokens' was released. Two months later, despite sustained interest in gaming tokens, the initial cracks in their hasty implementation are beginning to show. Given these developments, we find it crucial to reexamine the gaming token phenomenon, approaching the subject from a fresh angle compared to our previous discussion.

We plan to delve into several key areas:

The standard strategy for launching a token.

The anticipated consequences of the recent spike in token launches.

The feasibility of maintaining sufficient liquidity to support the influx of new Web3 projects alongside these token launches.

Comparisons between the current and previous bull cycles, highlighting what has improved and what errors are being repeated.

Alternative fundraising strategies that studios might employ to stand out: exploring the potential next trend in the industry

The Current Playbook

Over the last 3-4 months, gaming studios have generally followed a four-step strategy for launching gaming tokens:

Initiate or integrate with an existing NFT collection to provide token allocations or airdrops.

Roll out an alpha or beta version alongside a play-to-airdrop (P2A) campaign.

Conduct a presale of the token to communities, DAOs, and KOLs.

Officially launch the token and list it on exchanges.

1. NFT Collections as Token Gateways

Studios have increasingly tied token rewards to NFT collections, making such rewards a crucial feature to attract interest. This strategy has become almost a necessity for new gaming collections to gain traction. However, the effectiveness of token rewards is seeing a diminishing return as more projects adopt this approach, leading to a saturated market where the novelty of token rewards is less appealing to potential buyers.

2. The P2A Campaign

Typically, these campaigns involve announcing a P2A campaign, launching an alpha or beta version for players to earn (points towards) a token airdrop, and later enabling these participants to claim their tokens. While successful in generating initial hype, converting this incentivized engagement into long-term, genuine player interest remains a significant challenge.

3. Presales

This phase involves reaching out to communities, DAOs, and KOLs, for early token sales. Although these presales can offer quick returns on investment due to shorter vesting schedules, the risk of prolonged liquidity lock-up can be underappreciated, presenting a gamble on the future token value.

4. Token Launch and Exchange Listing

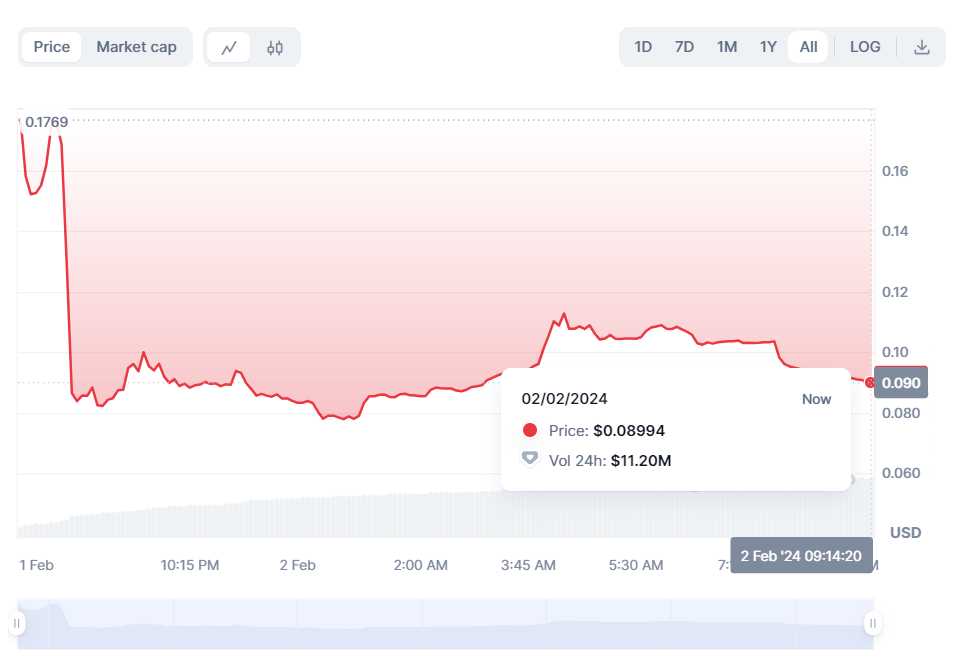

The final step involves the official token launch and listing on DEXs or CEXs. Post-launch, there's often a sell-off from airdrop participants and early-round investors looking to realize gains, putting pressure on the token price. Successful projects need to build enough momentum to attract purchases beyond these initial sellers. While some tokens like BIGTIME, ZTX, and GRAPE have seen an outsize demand surge post-launch, more recent examples such as $FAR (Farcana) and $MXM (MixMob) are showing the demand is becoming diluted, with studios delaying launches in response to deteriorating market conditions.

Do Projects Need a Token?

Not every game benefits from or logically incorporate a self-governed token; some may find adopting a stablecoin for their game economy offers a simpler, more sustainable solution.

Projects that didn't succumb to the pressure (Azra Games for example) are looking even better in my opinion as they are focused on building the thing that matters - the Game, the economics are only secondary unless you are just pretending to be in Web3 Gaming but are a gamified trading platform.

However, projects continue to launch their own fungible tokens (FTs) for several reasons:

Funding: With the venture capital environment remaining challenging, many projects struggle to secure additional financing. Tokens present an alternative fundraising method.

Visibility: Gaining players, essential for any Web3 game's success, currently relies heavily on generating buzz, particularly on platforms like Twitter.

Proof of Concept: Several studios achieved notable success with their gaming ICOs in Q4 2023, demonstrating the viability of such ventures.

It's also important to acknowledge that Web3 gaming is an emerging field ripe for innovation. There remains much to explore and develop, and pioneering a successful, sustainable approach to token utilization could prove highly rewarding.

Token Liquidity

Liquidity, particularly the influx of new liquidity, is a crucial metric for many existing projects contemplating the launch of a new token. Additionally, several well-regarded studios, which have been in development for the past 2-3 years, are preparing to release their games, indicating an increase in the number of new tokens entering the market.

As the gaming landscape expands, it appears to surpass the growth of new wallet activations or player entries in Web3 gaming, leading to heightened competition for a diminishing liquidity pool. For Web3 gaming to meet the liquidity demands of these new token launches, a broader retail market expansion, akin to a bull run, would be necessary.

Moreover, this industry is driven by meta or narrative trends, as highlighted in the aforementioned article. The success of TGEs hinges on the vitality of these narratives. While there currently seems to be (enough) demand to still see success, the gradual decrease in liquidity inflows and the narrowing multiples from presale prices suggest that this narrative may be losing its momentum soon.

Echo a lot of the sentiments already shared here. We're seeing a lot of games pile on with tokens because they want to get in on the meta and hype (to get attention/followers/UA) while it's still hot. I feel like some of these games themselves also know the window and remaining life in this meta is limited and are trying to rush to get theirs in before the music stops

Rushed Execution

A significant issue with many recent token launches is the apparent rush in decision-making and execution by studios, showing little consideration for long-term viability.

Being approached by games that barely have their gameplay figured out, yet want to launch a token before the halving to fit it in -> recipe for disaster.

Inevitably most (reward) token launches will follow the below pattern:

Token Launch: This stage often marks the peak of the game's visibility and the zenith of liquidity inflow.

Early Peak: While most tokens reach their highest value upon exchange listing, some games manage to attract and maintain interest for a few months, often buoyed by token rewards.

Decline to Zero: Over the following months and years, the token's value typically begins a gradual decline toward zero. This trend results from the constant outflow of tokens, as there's minimal incentive for players to make purchases.

Project announces play-to-airdrop, the project gets more players than they have ever seen or dreamed about, 1 month goes by, p2a is over, the token rapidly dumps, the project does not have a strategy ready to keep a healthy token price action, "players" go on to farm the next airdrop, projects fail to convert those temporary money farmoooors to actual players.

These challenges stem from several factors: inadequate emission schedules, insufficient control over the game's economic mechanisms, rushed token launches, flawed P2A campaign designs, a scarcity of players, and fundamentally, the absence of a game that engages players to spend based on enjoyment.

Will P2A Persist? And What’s Next?

The strategy of launching a token via a P2A campaign serves as a method for distributing tokens, shifting the focus from traditional staking rewards to earning tokens through gameplay. It's a straightforward concept that financially motivated player engagement can significantly boost a game's fundamental performance indicators. Payton explains the potential significance of this approach for securing funding in the image below.

P2A campaigns are likely to remain a fixture in Web3 gaming, not just for the reasons mentioned but also because they align token distribution more directly with meaningful product interaction. However, the conventional P2A model is becoming oversaturated and needs an update. To revitalize this approach, studios might consider several improvements:

Implementing ongoing reward mechanisms rather than single events, to sustain player interest and retention over time.

Beyond mere financial incentives, offering additional value to keep players engaged in the long term is crucial for maintaining their interest post-airdrop.

Introducing innovative reward distribution models like seasonal airdrops, loyalty programs, or quest-based rewards to keep the strategy fresh and engaging.

Addressing these points not only aims to convert token farmers into genuine players but also seeks to enhance the conversion rate of players into paying customers, particularly if the gaming experience is compelling.

What’s the Next Meta?

While P2A campaigns hold more promise than other token distribution methods, gaming studios are exploring additional fundraising strategies to differentiate themselves and capture the interest of their communities. Following the success of XAI, the concept of node sales has gained traction among several projects, including BlockGames, MetaxSeed, Cornucopias, and Hytopia, due to its popularity.

For consumers, the attraction to node sales lies in their potential for passive token earnings over extended periods. However, like token launches, node sales introduce further liquidity demands and tend to appeal primarily to investors seeking passive returns. This approach, though, cannot enhance in-game engagement or contribute to better player metrics, as it doesn’t incentivize meaningful gameplay interaction.

Given these considerations, P2A campaigns are expected to persist but with innovations for improved effectiveness. Similarly, the appeal of node sales as a means of passive income generation is likely to continue, albeit with the caveat that over-saturation could diminish their success rate, mirroring the challenges faced by token sales.

Observations Based on Current Playbook (Summarized)

Integrating a self-governed token into a game's ecosystem isn't always necessary, and some projects might fare better using a stablecoin. However, studios opt for tokenization for several key reasons: fundraising capabilities, the potential to draw attention, the lure of recent ICO successes, and the ambition to innovate within the space.

The strategy of enhancing NFT offerings with token rewards is losing its appeal and impact on market value, as evidenced by the tepid response to recent initiatives like PlayEmber's.

Recent months have seen a flurry of token launches, many of which appear hasty and ill-conceived, potentially repeating the pitfalls of the numerous launches observed in 2021 and 2022.

The diminishing returns on social engagement from current strategies suggest that fewer P2A campaigns will break through, leaving only a handful of high-quality projects to capture widespread attention.

Transitioning players from participating primarily for rewards (P2A) to playing for enjoyment remains a challenge, though some, like Pixels, seem to maintain player interest post-airdrop.

Token presales involving KOLs, communities, and DAOs have surged as an alternative to traditional venture capital, reflecting the tighter funding environment.

Despite its critiques, the P2A model is poised to continue, offering a form of engagement that tangibly ‘improves’ game metrics and (potentially) becomes increasingly relevant for funding.

The sustainability of the burgeoning number of TGEs hinges on the expansion of the retail market, possibly requiring a new bull market phase to meet liquidity needs.

With deteriorating market conditions in late January, many developers have opted to delay their TGEs, a cautious move in uncertain times.

It's common to see TGEs precede the actual game launch, leading to tokens with limited immediate utility and thus scant motivation for user spending.

Node sales as a fundraising mechanism have gained popularity among studios seeking community contributions, though this approach too may face saturation challenges over time.

Special Thanks To

Gcrod, RobinDS, Behold3r, Kix, Slayer, B1ZZ, Steps, EJM, and Whexon for actively contributing to the discussion and providing valuable insights.

Disclaimer

None of this is financial or legal advice.