What are the metrics or indicators of a successful NFT launch?

Defining NFT launch success through short-term indicators and long-term sustainability

The Return of NFTs?

In a market that had been dominated by meme coins, December marked a pivotal moment that shifted attention back to NFTs. This resurgence of liquidity in the NFT market can largely be attributed to Pudgy Penguins' PENGU token announcement. Following this, top collections and multiple “dino NFTs” saw a significant rise in volume and floor price over the subsequent weeks.

Additionally, the launch of the Onchain Heroes (OCH) Rings collection was an important catalyst in reviving interest in gaming NFTs. This event mirrors the success of Overworld’s Incarna mint last year in December, which triggered a gaming NFT bull run. Both mints stand out as the most profitable (paid) gaming NFT mints in their respective years.

Defining a Successful NFT Launch

Success in NFT launches is a multidimensional concept, encompassing short-term indicators during the launch phase and long-term sustainability post-launch.

Short-Term Success Metrics

1. Attention and Hype

Founder’s Leadership: Active and visible founders who communicate clear narratives build trust and excitement within their audience. Founders must be both visionaries and storytellers.

Example: Jeremy Horn (Overworld) and Gabe Leydon (DigiDaigaku) focused entirely on mint hype, driving momentum.

Data from Games Lab Analytics: "A clearly engaged and active founder leads to an active and engaged community, which correlates with higher royalty revenue per community member."

KOL Amplification: Key Opinion Leaders (KOLs) serve as attention multipliers, spreading project visibility across the Web3 ecosystem.

Antonio adds that gaming KOLs drive brand awareness and daily active users (DAU). However, they are less effective at driving direct sales, instead excelling at amplifying studio content and boosting link conversions.

Metrics:

Number of messages or engagement from founders.

KOL mentions, community sentiment, and Twitter metrics (likes, retweets, views, and comment depth).

2. Liquidity and Floor Price

Maintaining a floor price above the mint price is an early indicator of confidence and profitability.

"The best way to create a raving community of evangelists is to make them rich."

Projects must achieve critical buy-in within the first 90 days. Recovering momentum beyond this point is rare due to:

“New is always better” sentiment.

Lack of post-launch marketing ammunition (momentum peaks at launch).

Examples of Positive Launches:

Azuki and Pudgy Penguins delivered sustained post-mint value and status flex.

3. Community Adoption and Sentiment

Early signs of cult-like engagement include:

PFP Adoption: Community members showcasing NFTs as their profile pictures.

Participation: Active Discord engagement, event attendance, and organic Twitter discussions.

Metrics:

Discord online counts.

Active daily holders (DAH) and daily active users (DAU).

Challenges in Launches

1. Overhyped Launches: Over-reliance on narrative and hype creates "expectation debt”—unrealistic promises that erode post-mint confidence.

Example: Overworld invested heavily in marketing campaigns but avoided showing gameplay to preserve audience imagination.

2. Free Mints vs. Paid Mints:

Free Mints: Often attract flippers and struggle to sustain value unless carefully managed.

Paid Mints: Require stronger products, marketing, and favorable market conditions but generate more sustainable value.

Long-Term Sustainability Metrics

Short-term hype alone cannot ensure long-term success. Building a sustainable NFT project requires strategic execution, community nurturing, and consistent value delivery.

Key Components of Sustainability

1. Value Economics

Recurring, non-dilutive value for holders is essential. Examples include:

Revenue-generating utilities (e.g., Pudgy Penguins’ toy sales, Pixelmon’s royalty revenue share).

Enhancing utility through in-game benefits and interoperability (e.g., Infinigods Valhalla campaign).

Non-extractive monetization methods beyond mints or token presales.

2. Cult-like Community Building

Successful communities demonstrate alignment of vision, ownership, and advocacy. These communities act as organic marketing engines, driven by the “Web3 growth flywheel.”

Examples:

Miladys: Cult-like status drove their success.

Azuki: Consistent community trust reflected in sustained high floor price.

Forgotten Runes Wizard's Cult: Leveraged an existing fanbase.

Metrics:

Depth of engagement: Activity across multiple Discord channels.

Community-led initiatives: Events, contests, and organic contributions.

Mindshare: Continued use of NFTs as PFPs, threads, and holder-created video content.

3. Leadership and Vision Clarity

Strong leadership sustains momentum through clear vision casting and transparent updates.

Example: Today the Game lost credibility after a poor Limbo launch but restored trust through CEO Michael’s transparent leadership.

4. Product Readiness and Focus

Premature exposure through "build in public" strategies often leads to community fatigue. Alternative approaches include:

Time-gated launches with non-transferable NFTs until the product is ready.

Delivering complete products at (token) launch (e.g., Pirate Nation, Infinigods).

Unique Challenges of Gaming NFTs

1. IP Development vs. Game Success:

For gaming projects, the success of the game itself determines IP viability (e.g., DigiDaigaku, Overworld).

2. Budget Constraints:

Game studios often deplete budgets on development and marketing, leaving little for community reinvestment.

3. Timeline Misalignment:

Game development is slow, while Web3 communities demand instant gratification.

Solutions Suggested:

Early access programs (e.g., allowlists via in-game participation).

Value-driven drops during development cycles to maintain momentum.

Enhanced in-game assets that are worth more than their mint price.

Challenges of the Current Market

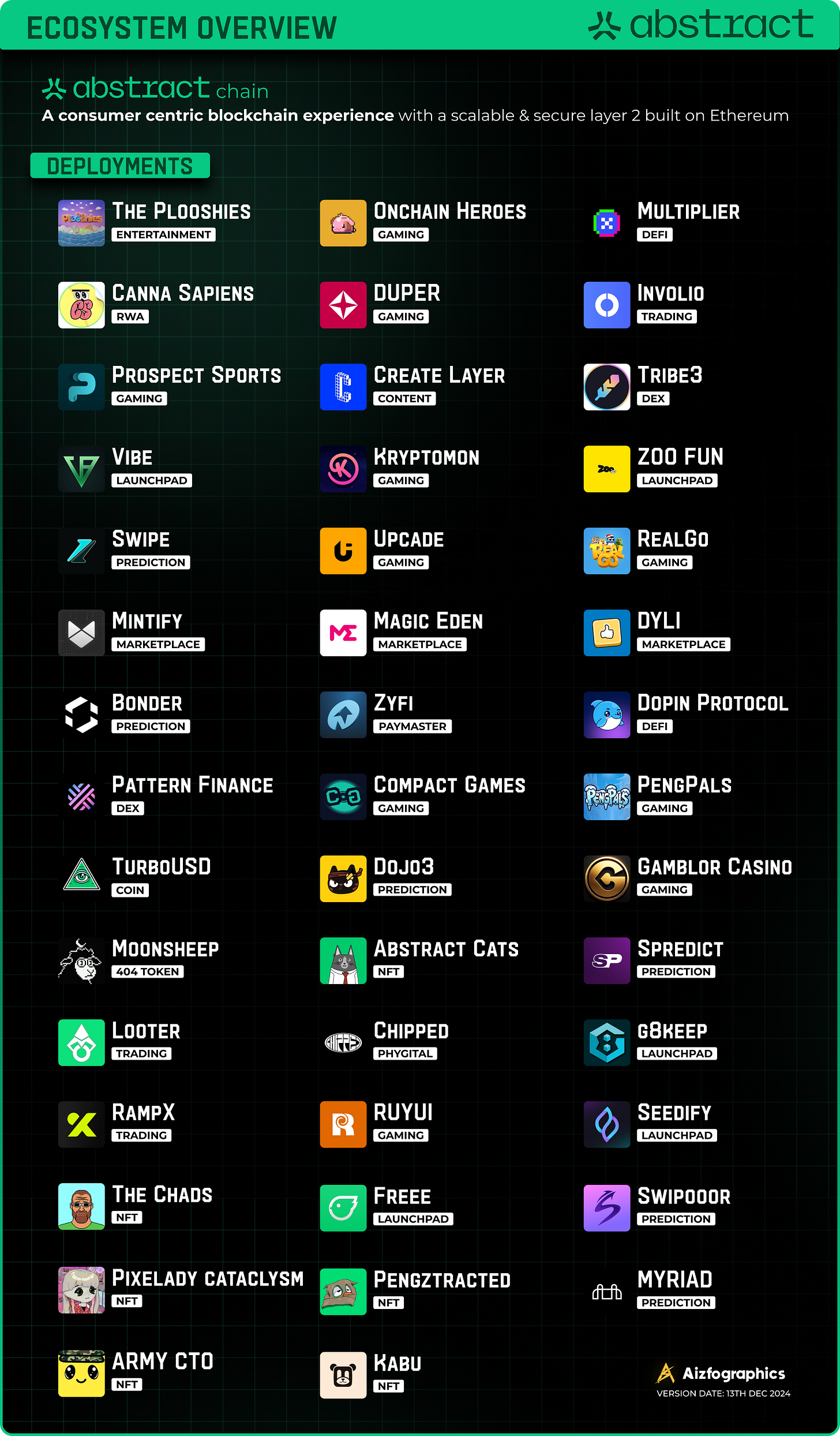

1. Abstract Chain Hype:

Immense hype surrounds Abstract Chain, but concerns remain about repeating past mistakes (hyped mints lacking staying power).

Concerns:

Mercenary flippers, time-gated Discord strategies, and short-term speculation.

Optimism:

Abstract’s roster of 300+ builders could drive market resurgence.

2. Flipper Behavior:

Free mints attract mercenary actors, eroding community loyalty.

Solutions Suggested:

Encourage reciprocity through rewards for long-term participation.

Educate Web3-native communities on realistic development timelines.

Seed organic engagement through town halls and campaign tours.

Closing: Rules of Thumb for Builders

To improve long-term sustainability, builders should adhere to these principles:

Curate Minters/Holders: Focus on loyal, curated holders rather than over-relying on alpha groups.

Build Value Over Time: Reward participation without creating extractive incentives.

Reciprocity & Ownership: Foster environments where holders feel invested in the project’s growth.

Communication is Key: Consistent founder updates and community engagement prevent negativity spirals.

Disclaimer

This article is largely generated by AI, based on the answers from the community to the “Question of the Week”.

None of this is financial or legal advice.