Wolves DAO Files #19: Value Accrual in NFTs

From the perspective of a retail investor, what kind of value accrual do you seek in NFTs?

Intro

In Web3 gaming, financial speculation once stood as the sole driving force behind retail's acquisition of NFTs and tokens. Nonetheless, the prolonged downturn in the market unveiled the unsustainability of this investment strategy, evidenced by the substantial number of P2E projects that faded into obscurity. Consequently, the broader NFT market also felt the impact, with the floor prices of numerous blue-chip NFTs experiencing declines, as seen with Azuki and Degods, for instance.

2021: number go up

2022 - 2023: product, experience, creator support, tech exposure

The industry's evolution is gradually shifting from a profit-centric approach to a product-oriented perspective. This transformation stems not only from retail investors seeking more stable investments but also from the increasing quality of new entrants into the space. Projects that fail to clearly articulate the problems they aim to solve will likely struggle to establish a viable and lasting business model.

In light of this changing mindset and the growing awareness among retail investors, there is an increasing demand for investments that are sustainable and offer value accrual. In response, the Wolves delved into this concept, emphasizing the significance of value accrual mechanisms and providing concrete instances to illustrate this notion.

Please note: While NFTs and tokens are indeed categorized as products, it's important to acknowledge that retail buyers, often viewed as investors, predominantly acquire and exchange these assets for investment purposes.

Value Accrual in Web3 Gaming

Gaming stands out as one of the most evident use cases for NFTs. It leverages proven existing models, elevates the concept of collectibility, and establishes ownership, among other reasons. Within this domain, various innovative mechanisms have been adopted by Web3 gaming studios to enhance the value of their NFTs over time.

In essence, the process of value accrual in Web3 games ultimately hinges on the game's ability to gain popularity, which naturally spurs demand for its NFTs. Nonetheless, it's crucial for these digital assets to offer sufficiently attractive utility to generate that demand. Below, we will delve into some examples of NFT models that are likely to stimulate substantial demand.

Factory NFTs

The Factory NFT model features a unique value accumulation mechanism, wherein the NFT itself functions as a 'factory' that generates additional (NFT) items. This means that the owner of such an NFT frequently acquires more NFTs by merely retaining the original one, or these NFTs act as production components. In the latter scenario, the holder must engage in certain activities within a game to produce more NFTs.

Given that factory NFTs often facilitate passive income, the concept of sustainability becomes a prevalent concern, emphasizing the significance of meticulous design choices in this domain.

Examples include:

Civitas

Parallel

LimitBreak

Battle Pass

Comparable to the Factory NFT model, the Battle Pass (NFT) functions as a means of unlocking additional (NFT) items. However, there are notable distinctions that render this model more adaptable and sustainable. In gaming, players are accustomed to Battle Passes having a limited validity, often lasting for a single season. Monetization frequently occurs through the seasonal sale of these digital assets. This concept can be transposed to a Web3 game, where the need to repurchase a Battle Pass or expend currency to activate one can be introduced with minimal resistance from players.

Furthermore, this model offers enhanced flexibility in terms of reward pathways. It determines how, why, and when players acquire (NFT) items or tokens. In contrast to situations where a land sale (often a Factory NFT) might give rise to potentially unrealistic player expectations, firmly establish earning rules, or create rigidity that could hinder adjustments in the future.

Examples include:

Mighty Action Heroes

Wildpass

Revenue Distribution

A transparent and debated method of generating and enhancing value for holders is accomplished through revenue distribution, akin to dividends. The Grapes employs a mechanism where users can participate in soft staking of their Grape NFTs, earning them 'Bunches'. These Bunches correspond to a certain allocation of $Grapecoin. To fuel the sustainability of this coin the team already built six distinct revenue streams spanning multiple game experiences.

This model is referred to as 'debated' due to uncertainties surrounding regulations regarding revenue share models of this kind and the potential for them to be classified as securities. However, despite this uncertainty, such a model establishes a direct alignment between the interests of the studio and the holders. Creating a clear incentive for holders to advocate for The Grapes' success.

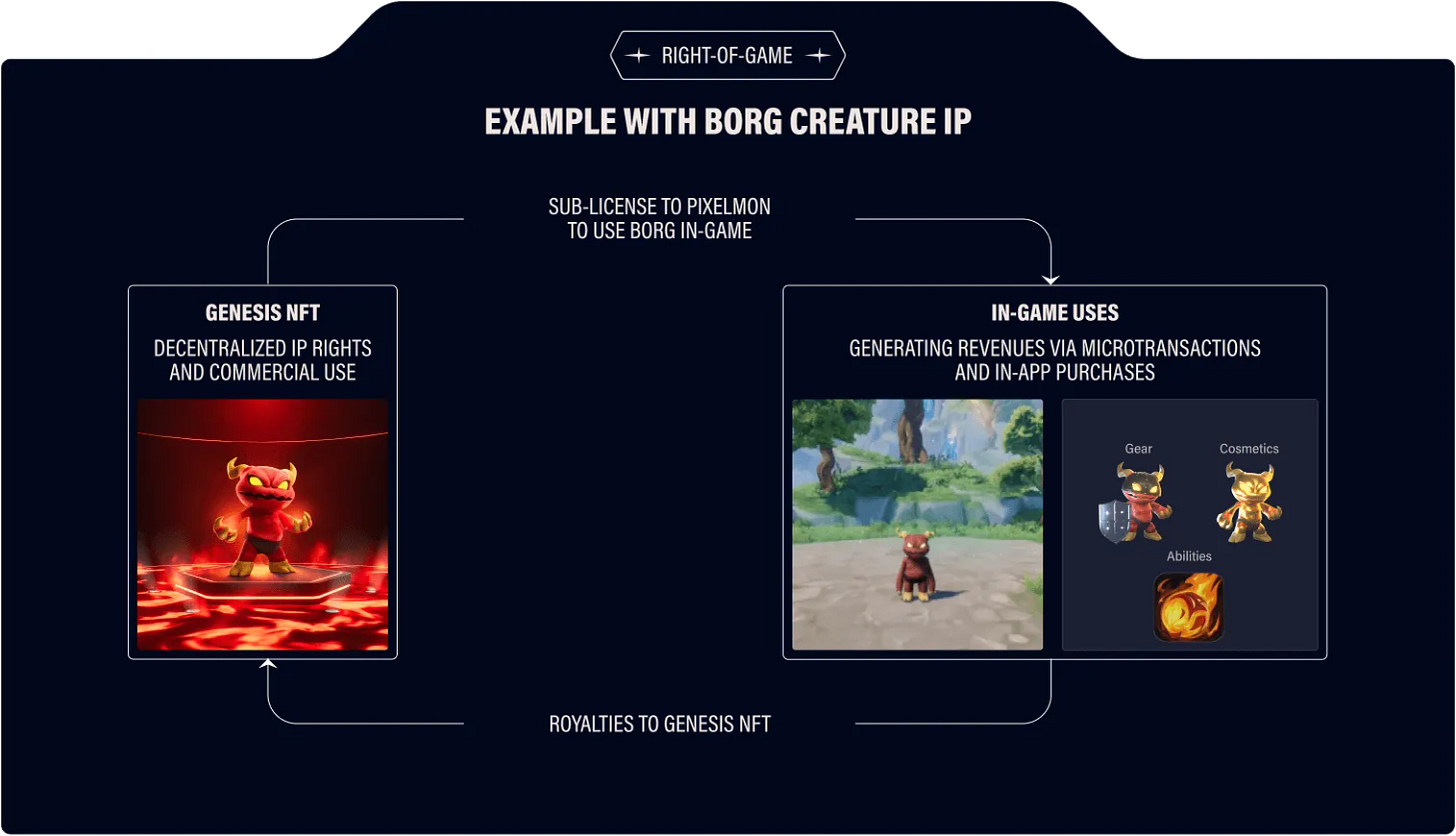

Shared Royalties

In a manner akin to the approach of distributing revenue through tokens, certain Web3 studios have adopted a shared royalty model. For instance, Pixelmon's Genesis NFT collection introduces the concept of IP decentralization, bestowing shared intellectual property rights upon the owners of these NFTs. Implying that the NFTs offer a contractual entitlement to royalties derived from any commercial application of the corresponding intellectual property. These royalties stem in part from the proceeds generated by in-game NFTs through microtransactions and in-app purchases (IAPs).

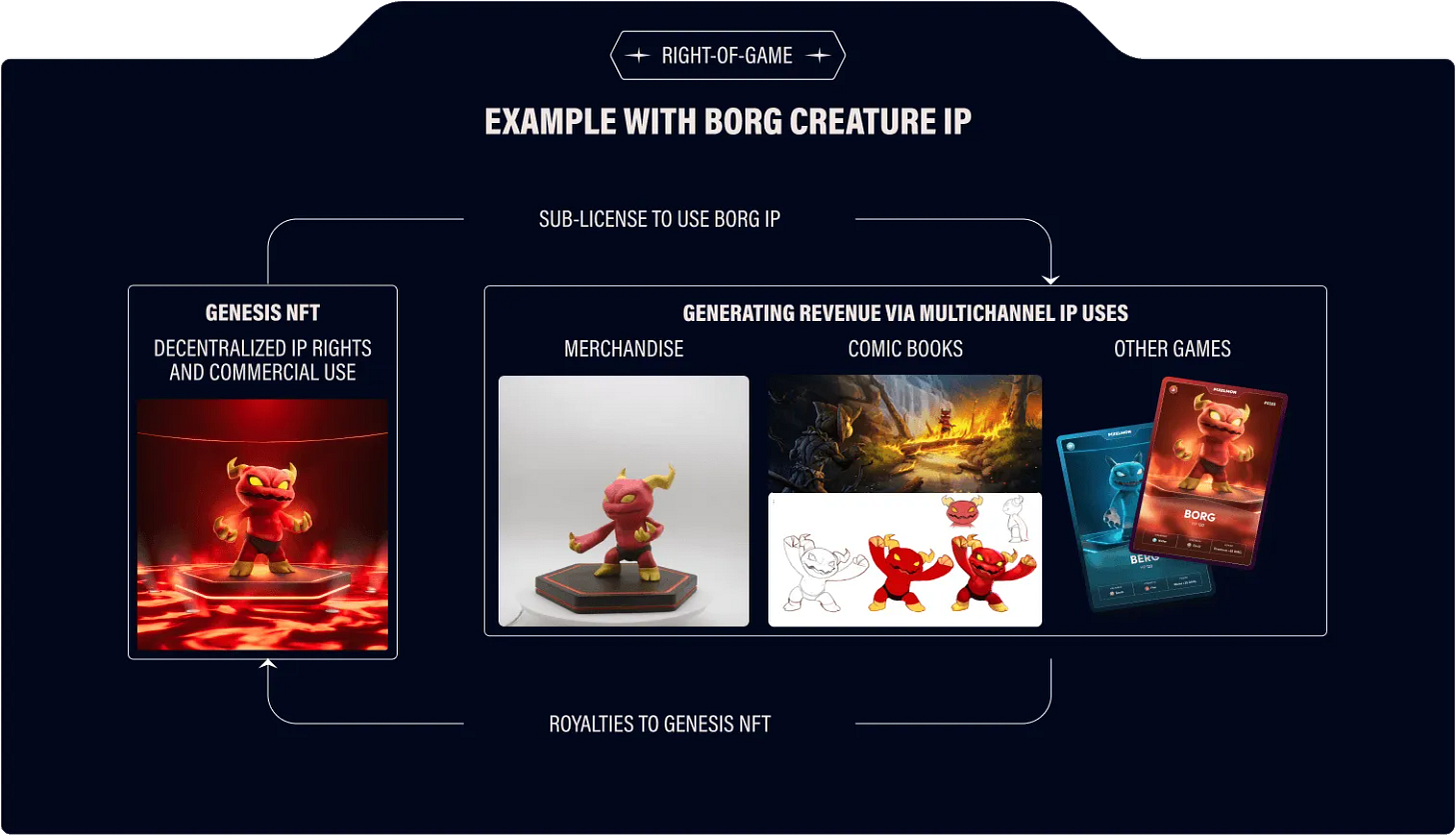

Going beyond Pixelmon's internal games, the Genesis NFTs afford holders the opportunity to seek out, negotiate, and capitalize on intellectual property while earning royalties. The intention here is to establish a decentralized incentive system that propels the growth of intellectual property across various domains. Reminiscent of how Pokémon has emerged as one of the world's largest intellectual properties by granting sublicenses of their IPs to diverse forms of media, merchandise, and more.

The concept of value accrual becomes particularly captivating when it comes to motivating holders to expand their own intellectual properties (IPs) across various domains, thereby generating numerous avenues for increased recognition. Potentially establishing a range of distinct networks capable of fostering IP growth, subsequently contributing to the expansion of the game itself. This interconnected growth trajectory could consequently drive higher demand for their NFTs.

Other examples:

Overworld

LimitBreak

Cross-Title / Ecosystem-Wide Utility

Creating utility for holders across a portfolio of games or applications offers another avenue for implementing value accrual. The underlying idea here is that the broader the range of games in which an NFT holds value, the greater the potential for the NFT's value to appreciate. Creating more opportunities to stimulate demand.

The Yuga Labs ecosystem serves as a prime illustration of how this model operates. As they continue to expand their ecosystem with diverse games and experiences, their original collections retain a form of utility. For instance, in Dookie Dash, Bored Ape Yacht Club (BAYC) holders were granted Sewer Passes, whereas spin-off collection holders received lower-tier passes. Furthermore, the BAYC owners were granted special in-game privileges in Otherdeed.

How Yuga Labs sees NFT holders: Value for holders lies in experiences Yuga Labs builds with the goal of creating intrinsic value for their NFTs, holders aren't just "consumers"

~ Wale.Swoosh

The impact of Yuga Labs extends even beyond its own games, as evidenced by its recent IP licensing in WreckLeague. The arrangement enables holders of Yuga NFTs to acquire themed NFT items while engaging with the game.

Other examples include:

Infinigods

Illuvium

Gameplay Advantages

NFTs that confer in-game advantages to players share similarities with in-app purchases (IAPs) that offer similar benefits. In mobile gaming, a percentage of players opt to spend in order to gain a competitive edge, bypass certain game content, or accelerate specific processes. A monetization model often referred to as pay-to-win (P2W), which is a highly effective approach for generating developer revenue. However, P2W is also subject to criticism due to the unfair advantages it grants spenders, potentially disadvantaging players who can't invest in competitive scenarios.

And, if it isn't a pay-to-win tool, will the said game be relevant enough for the holder to be satisfied with their asset ownership? References - Valorant, Dota

Nonetheless, NFTs that provide gameplay advantages offer a clear avenue for value accrual. Not only due to the established success of P2W models but also because of their widespread familiarity, particularly in Asian markets. This familiarity makes such NFTs a more intuitive option for driving demand once a game gains popularity.

Examples Include:

Infinigods: Elder Gods

Benefits of Clear Value Accrual Mechanisms

Gaming studios that proactively describe the value accrual mechanisms embedded in their NFTs, even prior to minting, gain the advantage of enhanced price discovery. The practice establishes accurate expectations and aids in determining a stable price for the NFT, avoiding excessive speculation.

Making the utility mechanisms in your NFTs clear means the value will be more easily calculated/reflected in your floor price.

Diminishing speculative trading carries both positive and negative implications, but it primarily reduces the appeal for investors to engage in such activities.

Design Considerations

While crafting value accrual mechanisms to primarily benefit core holders or early supporters holds significance, it mustn't come at the expense of welcoming new users. This misstep is frequently observed with the Factory NFT model, where numerous projects prioritize short-term incentives, consequently diluting the value of their NFTs rather than employing the model to foster user growth and engage their foundational player base.

Make it clear and be laser-focused on it as I think many want to accrue value across 20 categories instead of focusing on a single clear pathway. So having a very clear outline of how they imagine getting value back to me is the same logic that an equity investor should apply.

Moreover, aside from the importance of providing clarity as previously discussed, focusing on a single or a concise subset of value accrual mechanisms in a studio is also crucial. Broadly applying these mechanisms can dilute efforts and prove to be ineffective, considering the recognized monetization methods within gaming ecosystems.

Conclusion

In summary, Web3 gaming has undergone a profound shift from a speculative orientation towards a product-centered approach, largely prompted by the realization of the limitations of short-term financial speculation. A transformation that has been spurred by the maturation of the sector and the increasing quality of entrants.

The value accrual mechanisms within NFTs have emerged as a pivotal facet, presenting various avenues for enhancing the value of these digital assets. From Factory NFTs that generate items to Battle Pass models that unlock more assets, and shared royalties that allow NFT owners to partake in IP profits, these mechanisms offer innovative ways to reward NFT holders. Moreover, the creation of utility across multiple games or applications and gameplay advantages are strategies that can stimulate demand for NFTs.

While the industry evolves, clear articulation of value accrual mechanisms, together with prudent design choices, becomes vital. By striking a balance between rewarding early adopters and attracting new users, while maintaining a focused approach to value accumulation methods, Web3 game studios can shape a more sustainable and engaging future for NFTs in the gaming ecosystem.

Special Thanks To

Animositas, Riptide, Marklar, StoicJay, Bogdan, Hyper, Apix, Thare, 0xDrs, Graslo, Solodex, Whexon, RobinDS, Marcmcg, The NPCEO, TanyoG, Jihoz, Arto, and B1ZZ.eth.for actively contributing to this discussion and providing valuable insights.

This Substack post was put together by @Web3_Memento.

Need Help?

Need market intel and advice to help your Web3 project succeed? Get in touch with The Wolves today and receive a free consultation!

Disclaimer

None of this is financial or legal advice.