The Value Thesis #5: Cambria

A detailed breakdown of Cambria the game and its ecosystem (NFTs, tokens, etc.)

Disclaimer: None of this should be taken as financial or legal advice. DYOR. Additionally, this piece represents the opinion of Memento, who’s a holder of Cambria Cores.

Runescape for Crypto Natives

Cambria is an onchain MMO with “real stakes and onchain significance.” It brings together skilling, PvP, PvE, trading, politics, banditry, and exploration to create a complex digital economy driven by risk and reward.

Inspired by old-school MMOs such as Old School RuneScape (OSRS), Tibia, and Ragnarok Online, Cambria features a pixelated aesthetic, top-down view, and a medieval fantasy setting.

A Collision of Nostalgia, Degens, and Collecting

Cambria was built on the idea that many NFT traders and degens were once kids grinding virtual gold in RuneScape, priming them to understand digital economies, speculation, and high-risk trading behaviors. This overlap forms Cambria’s hypothetical core market, which can expand across multiple verticals: high-risk gaming, net worth growth, and online multiplayer interactions.

This idea was further validated by the investor update below, which highlights:

The importance of social dynamics, and

The thrill of massive onchain stakes:

“It didn’t seem to matter whether money was lost or won, the collective thrill was still the same.

As a risk-to-earn MMO, this is exactly the experience Cambria aims to deliver.

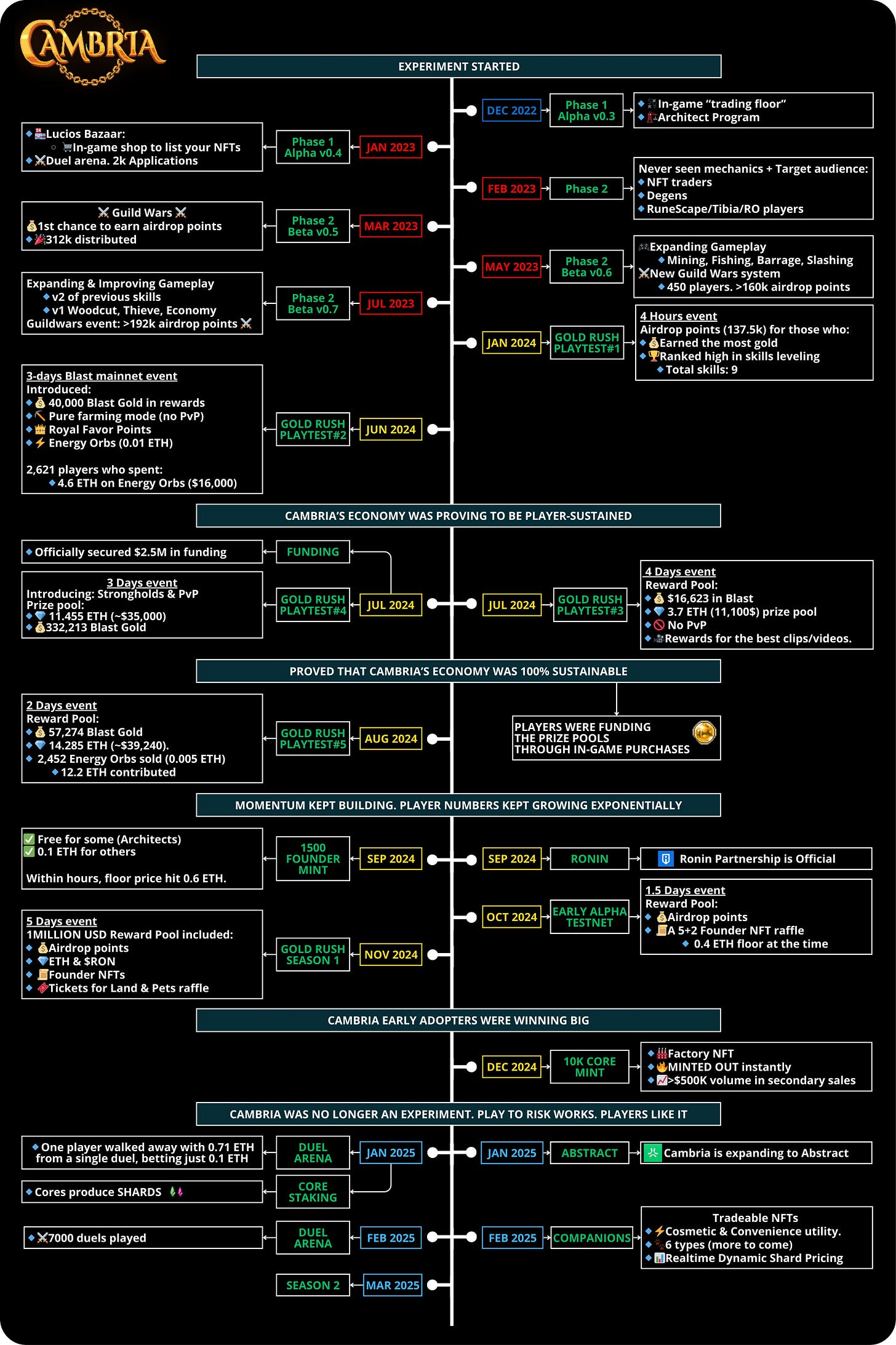

Cambria’s Development

Starting in the fall of 2022, the game has come a long way from its early stages to where it is today. Cambria’s approach to development can be observed through its announcement channel and blog updates, described as a “scrappy Web3 dev playbook”:

Experimental ideas →

Playtest with core users →

Gather feedback and analyze →

Iterate and refine →

Expand features and scale 🔄

The first iteration of Cambria included a virtual world (Gathertown?) where players could gather and trade NFTs, as shown in the screenshot below. NFTs were stored in an in-game bank, which players could transfer to their inventories and trade directly with others, RuneScape-style, through P2P trading. Gathertown played a key role in establishing Cambria’s foundational community. Over the past couple of years, the team has iterated continuously, building out the game rapidly with a solid base of content.

The Degen Arena

Degen Arena (formerly known as Duel Arena) played a major role in Cambria’s rise. This mode offers straightforward combat, where players challenge others in the lobby, set duel terms, and determine the stakes. As shown in the screenshot below, wagers can run into the thousands of dollars. Real-money wagering is central to the excitement of this mode.

Degen Arena is a game mode inspired by OSRS’s now-removed Duel Arena. It was taken out of OSRS in July 2022 due to the controversial practice of coin staking, effectively a form of gambling, as coins held real-world value on grey markets.

Cambria’s Duel Arena first launched on Base, then migrated to Blast in 2024. During the private Alpha on Base, players staked $14M in ETH across 100K transactions. In the first three months of “Blast Season,” over $88M in ETH was wagered, generating more than $1.3M in fees for Cambria, an impressive feat.

There are several reasons why this game mode proved so successful:

Familiarity: The concept was already well-known to many gamers from OSRS, a game which is believed to have a significant overlap with the crypto-native audience.

Spectator Appeal: Participation wasn’t required to enjoy the action; duels took place in a public arena. This visibility allowed players to showcase their skills, build reputations, and flex their earnings. Players could also purchase emotes and rare collectibles with Arena tokens, personalizing their presence and engaging with both challengers and the audience.

DeFi Meets Gameplay: It’s DeFi, wrapped in an engaging game loop driven by risk-taking, financial speculation, and optimization. The “trader crowd” is drawn to this format, where big wins (or losses) mirror the experience of trading memecoins. Importantly, the time investment is minimal.

Strong Incentives: Blast Points and Gold provided strong motivation to drive volume through the app, especially since Cambria received a high allocation. Additional in-game earning opportunities, like the Excalibur Pool and weekly cashouts, created a system of ongoing financial rewards.

Gold Rush

While Degen Arena played a pivotal role in Cambria’s rise, it represents only a small part of the overall game. Cambria’s Gold Rush events are competitive, time-limited playtests of the risk-to-earn MMO experience. These events have been central to Cambria’s development and testing phases, helping refine gameplay, engage the community, and reward participating players. Gold Rush v0 launched in July 2024, and multiple playtests have taken place since.

Cambria Season 1

Fast-forward nine months of playtesting, and we arrive at one of Cambria’s largest activations to date: Season 1 Early Alpha. The first Gold Rush event following the Ronin migration took place in late November.

Royal Favor

During this 5-day event, players were tasked with extracting artifacts and other treasures from the wilds while accumulating Royal Favor, a currency used to earn free Bribes that unlock Trinket Airdrops, NFTs, and other rewards. Royal Favor could be lost upon death and earned by killing other players:

Season 1 Results:

Cambria Gold Rush: Season 1 Stats

9,600 players participated

5,340 Royal Charters were minted

33,699 Energy Orbs purchased

$209,300 total player spend (in just over 5 days)

The main prize pool for Season 1 totaled $266K, seeded by player purchases and an initial 9 ETH (~$33K) from the Cambria Treasury. Additional rewards included Trinkets (for the Cambria airdrop), NFT raffle tickets, Founder NFTs, RON, and Blast Gold. A creator program also rewarded top referrers, standout content, and streamers.

Upcoming Season 2 Prize Pool

In Season 2, players will directly split the USDC main prize pool at the end of the season, alongside a variety of other rewards, airdrops, and incentives (e.g., Abstract XP). All ETH and RON spent during the season fund the prize pool, meaning the more players who join and engage, the larger the pool becomes.

The value within the pool also underpins the in-game economy of Coins (Cambria’s tradeable in-game currency). The final prize pool distribution is primarily based on the amount of Coins held via the Cashout system:

90% – Coins Held (minimum 10+ USDC cashout)

5% – Critical Bug Bounty rewards

5% – Content Creator & Referral rewards

Timeline

While writing this piece, I came across a great overview from Arualex, which documents Cambria’s complete development timeline.

Note: It was created before the announcement of Season 2.

What’s Next?

In the screenshot below, Geo, a moderator in the Cambria Discord server, summarizes a past AMA that outlines what’s ahead for Season 2 and beyond.

Note: Now that the S2 docs are live, we have more clarity on the updated plans.

Season 2 will include:

“Major upgrades to the economic model based on S1”

The primary goal of S2 is to validate the core gameplay loop. If successful, future seasons (S3+) will move toward a global launch, supported by a major GTM push that includes:

A Web2 RuneScape-style GTM, targeting a mass-market audience via top streamers and YouTubers, designed to reach non-crypto players while still leveraging tokens and earning incentives.

Greater variability and control over the prize pool, allowing players to take bigger risks or opt for a more casual style without the fear of being diluted for not grinding (now we know these are Paymasters)

“Gamble Dungeons” in Zone T6+, featuring expensive keys and offering the highest-risk, highest-reward content in the game.

Content, Economy, and Monetization

Now that we’ve covered Cambria’s development journey, let’s dive deeper into its current game content, economic systems, and monetization model.

Core Content

As mentioned earlier, Cambria is divided into two core experiences: Degen Arena and Gold Rush. In this section, we’ll focus on the latter. Gold Rush currently features the following content:

14 different skills

Three main weapons: melee, ranged, and magic

Equipment

Resources

Potions

Food

Teleports

Dungeons

Magic

Treasure Chests

Skilling and Masteries

In Cambria Gold Rush, players can level 14 different skills from level 1 to 99. These include: Engineering, Fishing, Mining, Smithing, Woodcutting, Gathering, Hunting, Cooking, Crafting, Alchemy, Prayer, Charge Crafting, Agility, and Slayer. Skills are initially capped at level 40, and players can spend Coins to unlock higher level caps.

Beyond skilling, Cambria features a Mastery progression system, allowing players to enhance their combat power through a skill tree model split across Melee, Ranged, and Magic. Masteries provide passive bonuses, buffs, and unique abilities at higher tiers, along with resistances to specific attack types. This gives players meaningful build flexibility, for example, creating a high-DPS, squishy mage with added melee resistance.

The Map

Cambria’s map plays a key role in shaping player behavior, forcing constant trade-offs between risk and reward, determined by region tiers. Each region has its own ruleset: the higher the tier, the greater the potential rewards, and the greater the risk, both in PvP and PvE.

What happens when you die?

Item loss on death depends on the region tier.

Players always retain basic tools, quest/unique items, and Coins (Silver).

T1 is the designated safe zone. Beyond that, item loss escalates with each higher tier.

Players can be attacked in any zone outside T1 and T2—all other areas are multi-way PvP.

Attacking another player marks you as an Outlaw (“skulled”).

Outlaws face consequences:

Castle guards become aggressive

All items/equipment are lost on death, regardless of zone

Outlaw status lasts 4 hours (real time) from your last player attack

The “Stress System”

A core mechanic in Tier 3+ regions, the Stress System limits how long players can safely remain on expeditions. As players explore, fight monsters, and gather resources, they accumulate sanity damage, which introduces escalating penalties and risk. This creates pressure to extract before overstaying and potentially losing it all.

Energy system

Every player begins with 160,000 Energy.

Energy drains gradually outside the main cities and safe zones.

Logging in/out of a safezone costs one minute’s worth of Energy.

The higher the region tier, the faster Energy drains, further amplifying the risk-reward loop.

Energy regenerates slowly over time or can be instantly restored by 100,000 points using Energy Orbs:

Sold at 0.01 ETH in Season 1

Reduced to 0.0015 ETH in Season 2

Inventory, Items, and Durability

Most lootable items have weight, and your inventory has a maximum carry capacity. Exceeding this limit triggers negative effects, such as reduced mobility, which increases your vulnerability to Roaming Threats.

Additionally, all weapons, armor, and tools have durability, which gradually depletes with use. Once an item’s durability reaches zero, it becomes unusable. However, items can be repaired for a fee in coins.

Resources

During Gold Rush, players extract and refine resources gathered through skilling. Resource nodes spawn in different tiers, with higher-tier resources found in more dangerous areas.

Wagons

Wagons are movable vehicles used to transport heavy resources across long distances. While traveling, they can be attacked by both players and NPCs. If destroyed, the wagon drops all items in its storage, making them globally visible and lootable.

Below is a video showcasing these mechanics:

Corrupted Loot

During Gold Rush playtests, players were required to collect Corrupted Loot to compete on the Leaderboard. The chances of acquiring these items were influenced by both the Tier of the monster and the player's current reward multiplier.

Corrupted Loot is divided into three categories, each with different point values:

Artifacts:

There are four tiers of Artifacts. The tougher the monster, the higher the chance of an Artifact drop. The most valuable ones only drop from high-tier monsters and bosses.

Gem Piles:

Earned by looting Treasure Chests or defeating dungeon bosses. Each region contains a Treasure Chest that can be opened using a Key Fabrication, dropped by NPCs in that area. The higher the region’s Tier, the better the rewards. Loot from chests is randomized.

Curios:

A form of currency obtained through extraction skills like hunting, gathering, fishing, mining, and woodcutting. Higher-tier resources increase the chances of finding Curios.

To cash in Corrupted Loot (i.e., to earn in-game rewards), players needed to purchase a Royal Charter (Cambria’s version of a Battle Pass), priced at 0.0025 ETH in Season 1 (0.02 ETH in Season 2). A Charter was also required to gain experience beyond level 40.

Corrupted items carry a negative effect called Luster, which gradually drains their cash-in value, incentivizing players to trade them in rather than hoard.

Paymasters

While writing this report, Season 2 of Cambria Gold Rush: The Paymasters was announced, alongside documentation outlining the new content planned for the (delayed) April 7th launch.

Season 2 introduces a new player class: Paymasters, participants who shape the game not through combat, but through economic dominance. To become a Paymaster, a player must purchase and deposit at least one Royal Charter into the Syndicate Vault. This grants them passive control over the spoils extracted by active adventurers.

Each Royal Charter deposited converts to Syndicate Shares at a 1:1 ratio, entitling holders to a share of both ETH and in-game resources.

Two primary tax mechanisms fund Paymasters’ earnings:

New Charter Tax (25%)

Every new Charter purchase triggers a 25% tax.

This tax is instantly distributed across all Syndicate Share holders.

Every 5 minutes, the “Syndicate’s recordkeepers” share:

Total Charters Deposited (Global)

Your Charters / Total Charters

Your Ownership % of the Syndicate

Solo Cash-In Tax (15%)

When solo adventurers cash in Corrupted Loot to the Royal Treasury, a 15% tax is applied to their Coins and Royal Favor.

This tax is automatically distributed to Syndicate Share holders.

Guild members are exempt from this tax.

Every 5 minutes, the “recordkeepers” report:

Total ETH Earned from Charters

Total Gold Earned from Cash-Ins

Total Royal Favor from Cash-Ins

The more shares a Paymaster holds, the larger their tax cut. However, the total number of shares can inflate as more players buy Charters and issue new ones.

The Paymaster role is similar to the Viceroy, but more passive.

A single Charter can only be used for either Syndicate Shares or sponsoring Guild Adventurers.

Players with multiple Charters can participate in both systems.

Charters cannot be withdrawn once deposited.

Paymasters can benefit from chaos in the Crownlands:

Disrupting top guilds increases solo player volume (and taxes).

Killing top extractors reduces total loot extraction, raising the value of taxed coins.

Backroom deals, bribes, and bounty funding are all fair play.

An exclusive in-game Syndicate Hideout is planned for players with:

5+ Syndicate Shares, or

Founder NFTs

It will offer special utility functions, perks, and conveniences (details TBD).

Paymasters Mark

The Paymaster’s Mark is a dynamic bounty system that targets the most efficient extractors in Gold Rush, acting as an organic economic balancing tool.

How it works:

Players are marked based on:

Efficiency score

24h productivity

Lifetime productivity

Effects of Being Marked:

Visual Indicators:

Marked players have a visible ring around them.

They appear on the world map (30-second delay).

Gameplay Penalties

Death Penalty: Lose ALL items on death, regardless of region.

Increased Vulnerability: Take 15% more damage from PvP attacks.

Restricted Mobility: Cannot use Teleport Tabs.

Energy Tax: +10% Energy consumption while marked.

Viceroys (Guild Owners)

The Viceroy class was introduced in Season 1 of Cambria Gold Rush and has been slightly updated in the Season 2 documentation. Viceroys act as guild managers, responsible for recruiting members and supplying Charters, Energy, and critical gear to help their teams compete on the Royal Favor Leaderboards.

To gain Viceroy status, a player must either:

Hold a Cambria Founder NFT, or

Mint and deposit at least 10 Royal Charters

Viceroys can create and manage guilds, with privileges including:

Creating Guilds and sponsoring teams using ETH and in-game items

Accessing Guild Chests to deposit Energy Orbs, Gold, Weapons, and Gear

Sponsoring members, giving them the resources they need to perform

Splitting Royal Favor between guild members and themselves, using a customizable percentage set and negotiated with each player

Delegating “Slots” to free-to-play players, allowing them to play under the Viceroy’s sponsorship (i.e., using one of the Viceroy’s Charters)

Guild exit rules: Members can freely leave their guild, but must cash in all Royal Favor items from their inventory and bank before doing so.

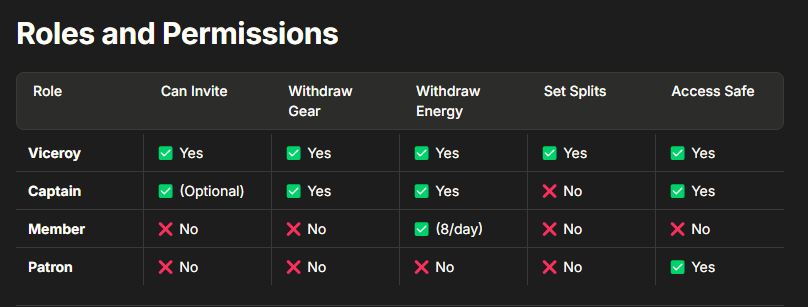

Guilds include four distinct roles, each with different permissions:

Viceroy

The guild leader. Manages overall strategy, sponsorship, splits, and recruitment.

Captain

Senior leadership with extended permissions.

Can withdraw Gear, Energy, and access the Guild Safe.

Think of them as your C-suite or operational leads.

Member

The field workers.

Can withdraw Energy Orbs, but have limited access to other items.

Patron

The VCs of the guild.

Contribute Charters and Energy Orbs to help fund guild expenses.

Receive a share of Royal Favor based on their Total Contribution Score (i.e., the ETH value of what they’ve deposited).

Viceroys have access to a dashboard for tracking member performance across both individual and guild-wide metrics.

Per Member

Total Royal Favor Earned

Royal Favor per Day

Total Resources Gathered

Energy Orbs Withdrawn / Used

Guild-wide

Total Split Revenue earned by Viceroy and Patrons

Contribution Ratios for all Patrons

Total Active Slots and Sponsored Players

These tools allow Viceroys to identify top-performing members, assess potential promotions, and make strategic, business-like decisions to optimize guild output.

Guild management functions as an economic metagame: a system of trust, coordination, and performance optimization. Viceroys are incentivized to:

Sponsor the most efficient adventurers

Monitor activity to ensure consistency

Adjust reward splits based on performance

Prevent defection or sabotage from within the guild

In return, Viceroys gain:

Higher placement on the Total Royal Favor Leaderboard

Strategic coordination to tackle tough bosses, including the World Boss and Guild Stronghold events

Strength in numbers—guilds can gang up to target top players

Exemption from the 15% Paymaster tax

Paymaster vs Guild Leader

In the breakdown below (from the Cambria S2 docs), the roles of Paymaster and Viceroy are contrasted across several dimensions: playstyle, onchain exposure, whale advantage, key risks, and more.

At a high level, these roles represent two distinct metagames:

Paymasters (the speculator class) profit by betting on macro trends: charter sales, player churn, and solo PvE deaths, benefiting from volume and volatility.

Viceroys, on the other hand, operate like guild managers, winning through optimization and control, managing teams, maintaining morale, and dominating in high-performance PvP/PvE events.

Players are constantly faced with a core decision:

Do I want passive, predictable returns (as a Paymaster) or volatile, skill-based upside (as a Viceroy)?

This tradeoff creates a cyclical metagame:

If Viceroy performance drops, → Paymaster value rises

If more Shares are issued, → value per Paymaster declines

If guilds dominate → more players join them, reducing solo deaths → Paymaster ROI shrinks

The result is a self-balancing ecosystem, shaped entirely by player choice.

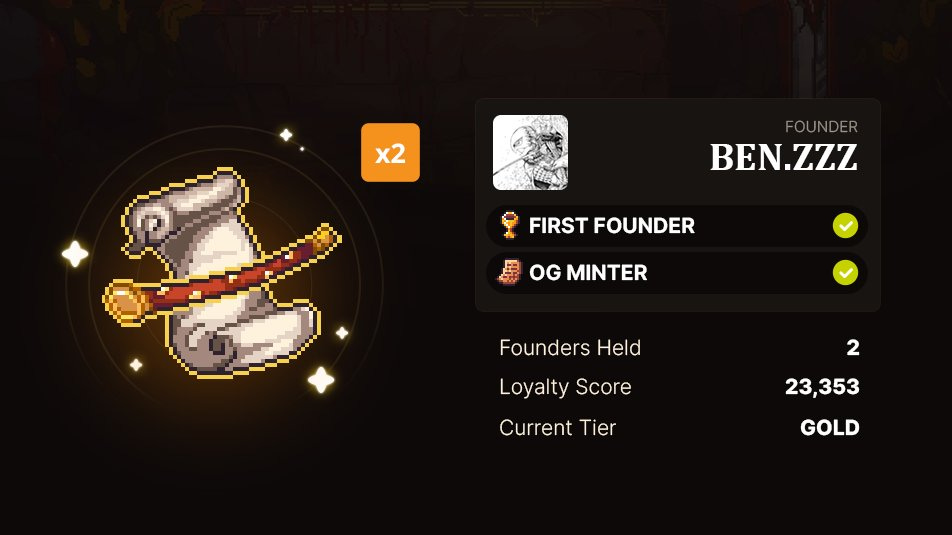

Back in October 2024, before the Paymaster role was publicly revealed, BEN.ZZZ shared the following message. In it, he discussed the idea of “building macro ETH deployment opportunities layered on top of each season”:

Selling Items for Gold

Players can sell items at two primary locations:

The General Store (NPC: Gokhan)

The Trading Post (NPC: Matilda)

General store

The General Store is located in all major cities and is run by the NPC Gokhan. It allows players to quickly sell items for Coins at their base gold value. Items sold to the store become available for others to purchase, but with a 2x markup.

Trading Post

In Cambria’s main city, the Trading Post, operated by NPC Matilda, acts as a player-to-player auction house, similar to the Grand Exchange in OSRS.

Here, players can:

Browse available items

List and sell their own goods for gold

Check trade history

Buy directly from other players using in-game currency

Seasons

Major content updates will be released each season, with their own economy, prize pool, and rewards. In the past, player progress was reset after each playtest. However, the image below suggests that progress will be preserved in future seasons, presumably after the full game launch.

Future Content

In an interview, BEN.ZZZ spoke about the upcoming “full Crownlands” experience, expected later this year. This will be a fully persistent, EVE Online-like (or more accurately, EVE Frontier–style) game mode, where players, primarily guilds, capture castles and control territory, with a strong emphasis on diplomacy-driven gameplay.

A comparable example is the decentralized MMO Citadel, which shares a similar design philosophy. Like Cambria, Citadel plans to monetize primarily through onchain trading activity (i.e., royalties).

Market Potential

Gauging Cambria’s total addressable market (TAM) is tricky, but we can make some rough estimates:

TAM (MMORPGs): Hundreds of millions (hard to pinpoint)

SAM (OSRS lifetime players): ~40 million

SOM (Cambria's potential reach): ~2 million? (very rough estimate)

This estimate becomes even more complex when considering whether Cambria can appeal to a broader audience. In a recent piece we published—“Why does Crypto Gaming Feel Stuck?”, we explored the distinction between Path 1 and Path 2 games:

Path 1: Mainstream-oriented games with abstracted blockchain mechanics (e.g., Off the Grid, NFL Rivals)

Path 2: Crypto-native games built around onchain systems (e.g., Wolf Game, Onchain Heroes, Citadel)

The growing sentiment is that games typically succeed by committing to one path. Attempting to sit in between often fails to resonate, posing a potential risk for the game’s growth strategy. However, there’s also believed to be a significant overlap between crypto users and former RuneScape players, or at least individuals who’ve played OSRS and now passively hold crypto.

Even if Cambria can’t match OSRS’s massive scale, it doesn’t need to. The game has already proven it can thrive with a smaller, high-spending core audience (another example). With only a few thousand active players, Cambria has demonstrated strong monetization depth, suggesting a profitable and sustainable future without needing mass-market reach.

Runescape

I took a closer look at Jagex’s 2023 financial report to provide more context on the market size and the company behind both RuneScape 3 and Old School RuneScape (OSRS). Here are the key highlights:

Revenue: £152M (~$196M), up 10% YoY

EBITDA: £67M (~$86M)

Subscription Growth: Continued increase in subscription revenue, with strong player retention

Subscriber Stats:

2.3 million total subscribers

1.2 million average daily subscribers

Revenue Breakdown:

74% of revenue comes from subscriptions

The rest comes from microtransactions, premium services, advertising, and other channels

Primary Markets: UK, EU, and the United States

Peak OSRS CCU: 185,000 players on November 16, 2023

For context, OSRS was launched in 2013, the same year RuneScape 2 transitioned into RuneScape 3. RS3 is considered the more casual and modernized version, with a less grindy experience and updated art style. Meanwhile, OSRS remains the more popular title, with larger player numbers and higher revenue.

Cambria vs. Runescape

By comparing the two side by side, we get a clearer picture of how each game functions:

Chain Migrations

Cambria isn’t tied to any specific chain and can be considered chain-agnostic. The game originally launched on Base, then migrated to Blast in 2024 to follow its user base. Later that year, it moved to Ronin (as part of Ronin Forge) to tap into greater player liquidity and diversify its audience. Most recently, a migration to Abstract was announced.

While this approach makes it harder to build a chain-native loyalist following (e.g., Ronin evangelists), the team has strategically used these migrations to unlock chain-level incentives, like Blast Gold and Abstract XP (scheduled to go live with Season 2).

Abstract as a Content Play

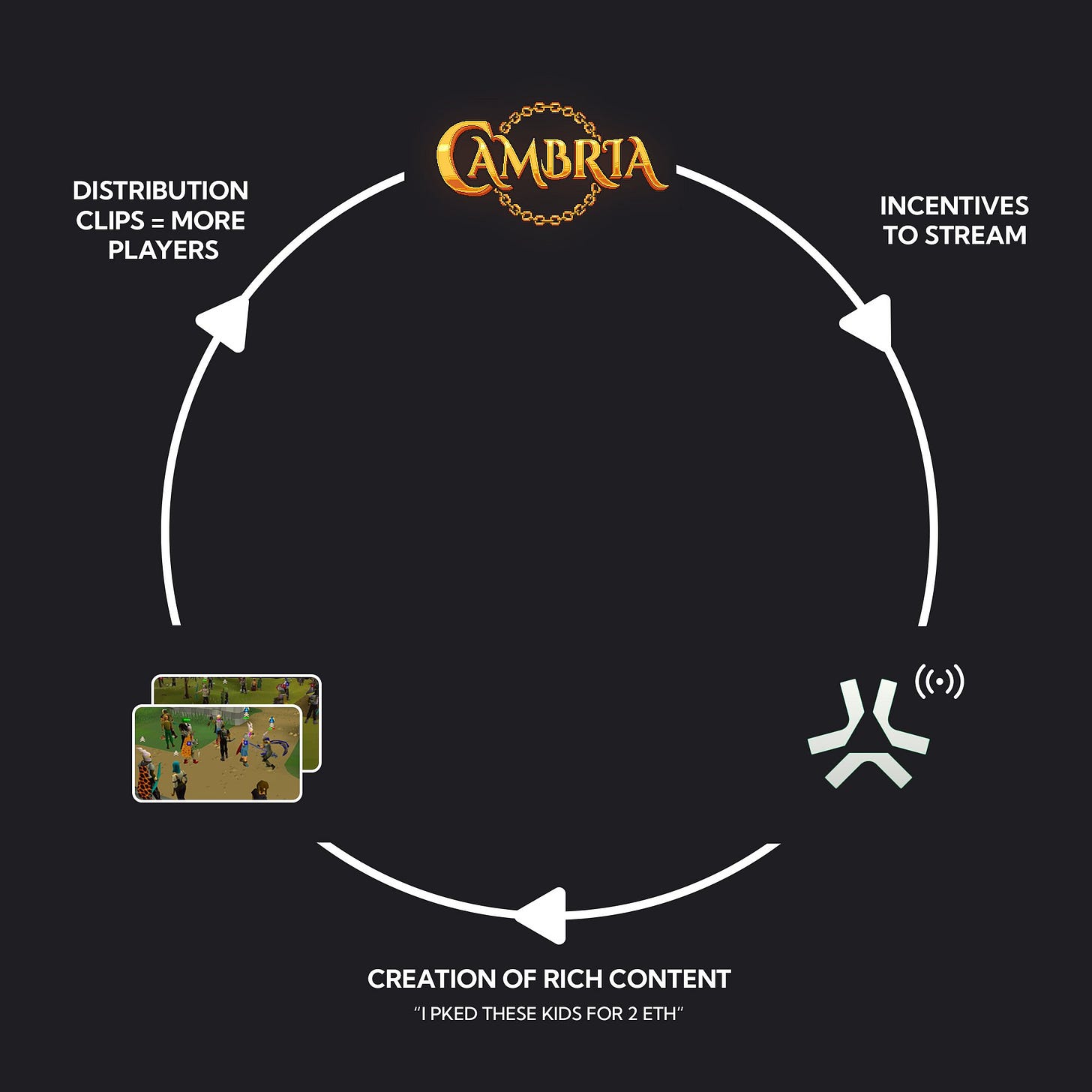

Another reason behind Cambria’s migration to Abstract is a content-focused play, as the chain offers native streaming functionality. I previously speculated that this move could lead to a surge in content creation, something that could play a significant role in Cambria’s distribution strategy:

“Many enjoy OSRS PK content because there's always a significant risk of dying and losing items. But what if dying meant losing $1000s worth of items potentially? That would make for some pretty good content. And then you also have content related to arbitrating, skilling, the duel arena, etc.

The amount of degen money involved in crypto (= opportunities) will be a strong amplifier of these clips and vids. Should lead to a lot more interest in crypto Runescape, as its player base is still quite condensed at this moment.” ~ Memento

“The S2 Thesis”

In conclusion, based on the information above, Season 2 is set to be Cambria’s largest season yet. Here’s why:

The Paymaster Role: This introduces a passive participation layer for DeFi enthusiasts, likely leading to more capital influx. Paymasters will drive a flywheel of increased liquidity and attention, similar to how Big Coin’s BIG chart attracts attention and liquidity through its own growth.

Abstract Streaming Flywheel: The second flywheel, driven by Abstract’s streaming incentives, will create a cycle of more streaming > richer clips > wider distribution > greater mindshare. This will help expand Cambria’s influence beyond its core community, with the Paymaster and distribution flywheels amplifying each other.

Season 1 Payouts: Players' earnings in Season 1 were impressive, especially compared to the average P2A payout today.

Player Base: Cambria’s player base has been condensed with high spenders (dolphins and whales). However, given the potential for high earnings, this season is likely to attract more farmer archetypes—players focused on maximizing their in-game earnings.

NFT Collections

To date, Cambria has launched three NFT collections (excluding in-game items):

Cambria Founders – the Genesis collection

Cambria Cores – the “factory” NFTs

Cambria Companions – the first collection produced using Cores

A fourth collection, Cambria Land, has been hinted at as a potential future release.

Cambria Founders

The Cambria Founders collection was minted in September 2024, roughly two years after development on the game began. The launch coincided with the release of Cambria’s Early Alpha and served as a way to reward early supporters who had stuck with the project over time. These Genesis NFTs helped form the core of the game’s community.

Genesis collections like this are typically launched to recognize and establish a core user base, and are often smaller in size than subsequent drops.

Mint Price: Free, 0.05 ETH, or 0.1 ETH (depending on contribution level)

Total Supply: 1,500 NFTs (on Ethereum)

Allocation:

Max 1 Founder NFT per wallet per phase

150 NFTs reserved for the treasury

Founders gain access to all future Cambria opportunities, including:

Guaranteed spots for future mints

Access to early events

Exclusive allocation to the Cambria airdrop

The mint was split into two phases, rewarding players based on their overall contributions, including:

When they joined the community

How many playtests did they participate in

Their involvement level (measured via Essence Points)

Whether they held rare in-game cosmetics (e.g., Party Hats)

Out of the 1,350 mintable NFTs, a small portion (estimated to be ~20%) was allocated to external communities. Below is a list of the holders who were whitelisted for the second FCFS phase:

GTM Strategy

Notably, the mint didn’t follow the typical NFT playbook, there was no month-long content campaign or broad KOL activation. Instead, it leaned on the core community built over two years of hands-on playtesting and organic excitement. In other words, it was product-driven, not marketing-led.

The “Loyalty Engine”

With the launch of the Founders collection, Cambria also introduced the “Loyalty Engine”:

“…the longer you hold at least 1 Founder, the more rewards you will be entitled to - more Founders (via raffle) from the Treasury, higher multipliers, and more access.” ~ BEN.ZZZ

Essentially, it scales utility for holders who keep their NFTs in their wallet over time. The Loyalty Score resets if a wallet sells all of its NFTs, creating a mechanic that rewards long-term retention.

“our main success metric for this collection will be the # of unique, quality holders that are directly incentive-aligned with us and the future Cambria protocol.” ~ BEN.ZZZ

Price and Holder Data

Cambria Founders saw strong price appreciation post-launch, opening at around 2.5x (based on a 0.1 ETH mint price) on secondary markets. In the months that followed, the floor price surged during the “gaming NFT season,” sparked by the success of the Onchain Heroes Genesis Rings collection.

On January 12, the collection peaked at 1 ETH before experiencing a slight pullback. It hit a local bottom of approximately 0.54 ETH on February 17, and has been trading upward since, sitting at around 0.71 ETH as of March 21. Naturally, broader market conditions, including ETH’s underperformance, influenced price trends.

Note: The chart below only tracks price activity from October 8, although the mint occurred on September 17.

With 948 holders (63.2% unique ownership), the collection’s distribution is relatively wide and decentralized. It’s believed that both the careful allocation strategy and the Loyalty Engine contributed to this decentralization and helped retain long-term holders.

Cambria Cores

Cambria Cores, the project’s second NFT collection, function as the ecosystem’s “factory” NFTs. Introduced in mid-December 2024 and minted on Ronin (following Cambria’s migration in September), Cores are utility assets that give players “control over the spice” (yes, a Dune reference):

“direct control over the issuance of Companion NFTs ("pets"), Skins NFTs (cosmetics), Lootboxes, and other high-demand items.”

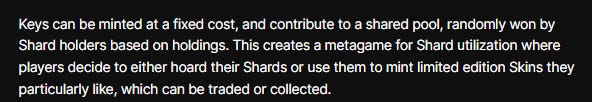

When staked, Cores generate Soulbound Shard Points (either Companion Shards or Skin Shards), which players can use to mint and trade companions, pets, and other cosmetics. Core holders choose how they want to spend their Shards, with some mintable assets being time-limited, creating a system where players actively participate in the economy of rare digital goods.

The number of Cores a player owns determines their Shard Yield Factor and their Tier (see chart below). Higher tiers grant access to exclusive items, such as rare skins, companions, and unlocks, based on the highest-tier Core held.

To access certain limited-time drops, players must have staked a Core at least 30 days in advance, encouraging long-term staking. Most Core-gated assets are non-transferable at the time of mint (with some exceptions), offering social flex value over pure monetary utility.

Lastly, Founder NFT holders benefit from reduced Shard minting costs for Core-gated items, up to 90% off, depending on their Loyalty Score.

Skins (Cosmetics)

Skins are released in Cambria through two primary mechanisms:

Lootbox Collections: Earned in-game and unlocked using Keys

Limited Edition Releases: Purchased on a bonding curve using Shards

The Lootbox system introduces a light metagame for Shard holders, who must decide how and when to unlock or hold based on rarity, timing, and potential value.

Currently, skins only apply to Companions, but future updates will expand their use to equipment, weapons, emotes, stickers, visual effects, and more.

Other Benefits:

Furthermore, Collectors can unlock badges and other collectibles based on their holdings and earn a Collector Score tied to their lifetime Shard spend. This score also grants voting privileges for future community collections that may be released.

Lastly, Shards contribute to various in-game player scores, which serve as bonus factors in the Cambria airdrop.

Collection details:

Mint Price: 20 RON (~$47 at the time)

Collection Size: 10,000 NFTs

Rarity Distribution:

Normal Core (T1) – 80%

Enhanced Core (T2) – 15%

Mystic Core (T3) – 4%

Arcane Core (T4) – 1%

Allocation:

Cores were distributed across a mix of:

Active players

Existing Founder NFT holders

Owners of in-game cosmetics

Selected whitelisted communities

Price and Holder Data

As mentioned, Cambria Cores minted for just 20 RON. After launch, they quickly 3–4x’d on the Ronin Market. Notably, following the NFT reveal on December 26, the collection avoided the typical post-reveal dip often seen in rarity-based speculation. Instead, it experienced only a minor correction, followed by a strong rebound in the days after.

The floor price for Tier 1 (T1) Cores peaked at around 120 RON, though exact figures are unclear due to DappRadar only reporting average sale prices (which include all tiers).

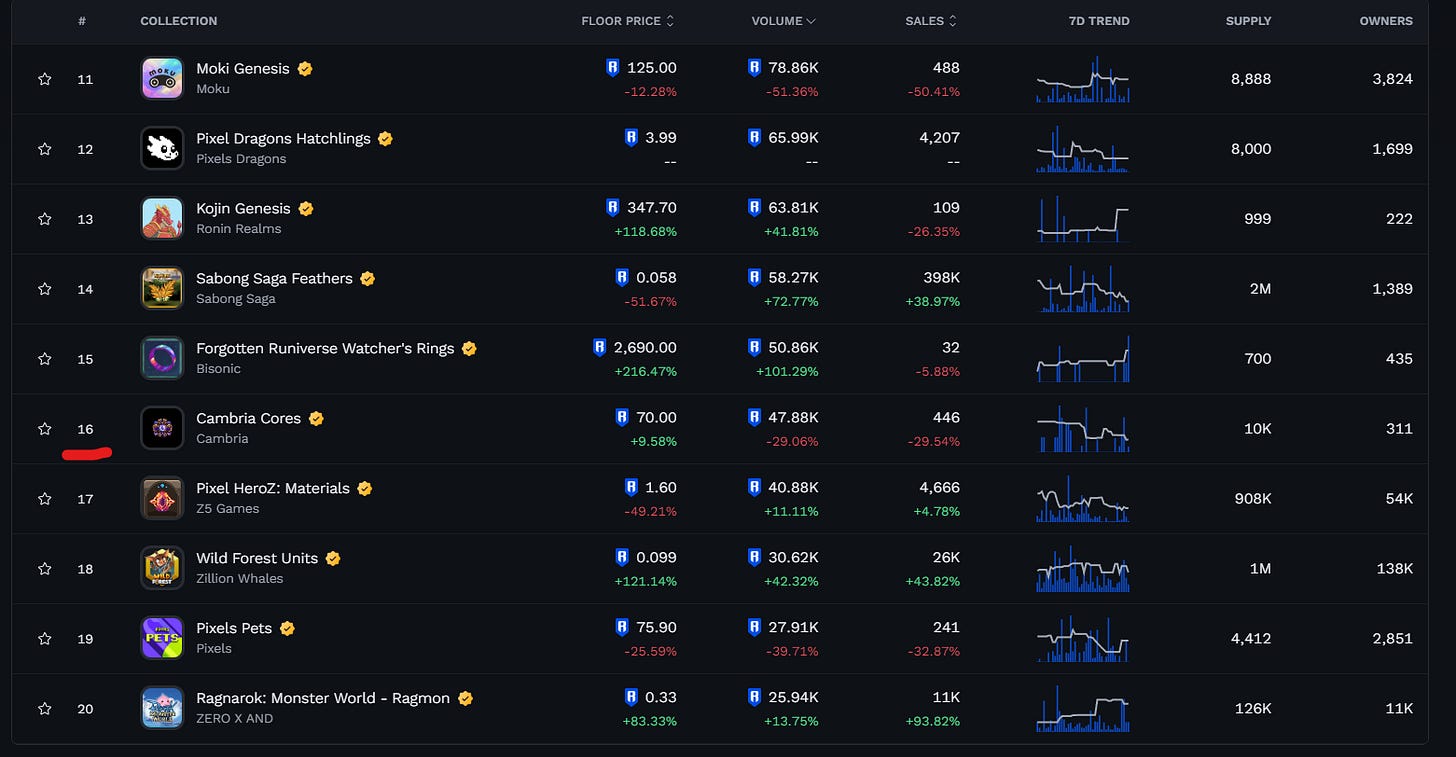

As of March 22, the collection shows just 311 unique holders (3%)—a number skewed by the hard staking contract, which has concentrated over 92% of the supply in a single wallet. The high staking percentage is a strong signal of holder confidence and demand for Cambria.

Over the past 30 days (as of March 22), Cambria Cores generated 47.66K RON in trading volume, ranking #16 among all Ronin NFT collections. It also sits at #14 in all-time Ronin volume, with a total of 523K RON traded. With Ronin's upcoming integration with OpenSea, this is expected to be one of the primary collections to benefit from increased visibility and liquidity.

Companions

Companions were the first collection mintable using Companion Shards, which are generated by staking Cambria Cores. These in-game creatures offer several layers of utility:

They are interactive and adapt to your playstyle

Each has a unique personality, catchphrases, and distinct traits

They provide buffs, such as increased bank space or auto-collection—buffs vary by companion archetype

Companions come in various rarities, with some featuring exclusive animations and effects

In one of his devlogs, BEN.ZZZ emphasized the importance of fostering personal attachment to digital collectibles, ensuring they feel more than just financial assets:

“to prevent the financial aspects of the game from reducing the game world down into a 1D yield vehicle to be maximally exploited.”

This philosophy aligns with what Jihoz (of Axie Infinity) has long advocated: designing NFTs with emotional utility. It’s also reflected in how Project O approaches collectible design, using systems like provenance, card progression paths, and grading to build lasting value.

The Thesis on Cores

To support the thesis on holding Cores, here’s why Dalteco, one of the largest holders, remains bullish:

I really love the factory nft model and I’m a top 5 (6?) core whale within the game. Cores generate all the NFTs and companions within cambria through the passive generation of shards, and it’s like infinite gacha as long as you have one. From an investment standpoint it’s pretty easy to see the value: staking cores gives u shards. Shards can be used to mint skins or companions that will be used in game. Those can be sold.

So you can profit from:

Cores going up in price

Straight up selling companions

Straight up selling skins

And only benefit if anything else goes up. Very comfy mechanism that if cambria blows up, can be really lucrative. Ofc if cambria dies it all dies too but that’s a given ~ Dalteco

Dalteco’s bullish stance on holding Cores revolves around their dual role as both an asset generator (for companions and skins) and an investment vehicle. The overall value of Cores is tied directly to Cambria’s success, making it a risk-on play with potential for high rewards if the game explodes, but with a complete downside if the game fails.

Cambria Land

Cambria Land NFTs remain largely undefined at this stage. However, in a recent interview, BEN.ZZZ hinted that they could function similarly to player-owned housing in OSRS. While land in Cambria is expected to have less focus on resource production, it will likely center around convenience.

In OSRS, housing plays a role in the Construction skill, allowing players to place useful features like teleports, rejuvenation pools, crafting tables, and training dummies. It’s speculated that Cambria Land could adopt a similar approach, with land serving to enhance player experience and ease of play rather than being central to resource gathering.

Token

As of April 2025, Cambria does not yet have a live token. While earlier communications indicated plans to launch the token in late 2024, the TGE was delayed, like many teams have. I don’t expect a token launch in Season 2, but we’ll likely see it closer to the Season 3 launch.

As previously mentioned, players have been collecting “Trinkets” during earlier playtests, which will eventually translate into token allocations. The screenshot below estimates the value of 5.1M Trinkets at approximately $1,500, based on the most recent token valuation.

Fundraising

Cambria was initially bootstrapped for over a year, building its audience primarily through the Duel Arena. In July 2024, the team raised $2.5M in a seed round, led by BITKRAFT and 1KX, with participation from notable figures such as:

Piers Kicks (Delphi Digital)

Soby (XAI)

Tommy Shaughnessy (Delphi Digital)

Bharat Krymo (6529 Capital)

Alex Brunicki (Backed VC)

Ben Roy (SeedClub HQ)

And others

Assuming a token launch in 2025, Cambria is expected to raise additional funds in a token round within the coming months.

BITKRAFT, known for its hands-on approach, is regarded as one of the most influential investors in crypto gaming. In 2024, they participated in rounds for projects like Avalon, Party Icons, Cartridge, and Smolbound. On the other hand, 1KX is one of the largest investors in the Ronin Network and has backed Treasure, The Sandbox, and Community Gaming in recent years.

Beyond venture capital, Cambria generated $1.3M+ in fees from the Degen Arena and raised an estimated <$100,000 in ETH and ~200,000 RON from its Founder and Cores NFT sales.

Team

The Cambria team is relatively small, consisting of 10-11 full-time equivalent employees (FTUEs) as of January 2025. The team operates remotely, with members scattered around the globe, and is made up of crypto natives, many of whom the founder has met throughout his career.

BEN.ZZZ

Since BEN.ZZZ remains undoxxed, not much is known about his personal background. However, in a recent interview, he shared details about his career, particularly his experience as a software engineer at a robotics startup, where he gained expertise in digital 3D modeling. Before this, he also did some freelance work as a developer. It’s also worth noting that Runescape is one of his favorite games, unsurprisingly, given Cambria’s inspiration.

Despite being undoxxed, BEN.ZZZ plays a pivotal role in the game's mindshare, trust, and success. To quote from Value Thesis #1: Overworld, analyzing Jeremy Horn:

“Data from Gameslab has previously shown that founders who are active and engaged with their community tend to increase revenue per community member”.

His close involvement with the community through Discord and Twitter has positioned him as one of the most prominent founders in crypto gaming. His community engagement includes:

Sharing development updates in Discord

Actively engaging with Cambria-related content on Crypto Twitter

Personally publishing blog posts and explaining his team's decision-making process, ensuring the community stays informed

Regularly posting Cambria updates and thought leadership content

Leading AMAs and interviews

Moreover, BEN.ZZZ spends significant time "in the trenches", minting NFTs from other projects, staying updated with crypto developments, and immersing himself in meme culture (he even has a milady). BEN.ZZZ is not just a founder, he’s one of the degens.

The Bull Case

Cambria has the right ingredients, community, product-market fit (PMF), funding, and more to succeed in the crypto space and expand its mindshare. The potential of what Cambria could become is well captured by the below Tweet from BEN.ZZZ, which envisions a mix of OSRS and The Hunger Games.

In a bullish scenario, Cambria’s growth strategy to attract a broader audience, including former OSRS players, would open up a larger SOM beyond just crypto gaming. This expansion would be further amplified by the game’s community and economic flywheels. Cambria could evolve into a massive game show, where not just thousands, but 100,000+ players compete for millions in prize pools, putting thousands of dollars on the line in the process.

Imagine whales fighting over sponsoring “Odablock’s” guild, one of the best PK’ers and largest YouTubers in OSRS.

On “Risk to Earn”

Ponzi-modeled games like Wolf Game, Onchain Heroes, and Big Coin have shown how massive onchain stakes can drive the excitement for crypto-native gamers. However, these games typically lose momentum as the chart (inevitably) tanks at some point.

In this category, Cambria stands a better chance of making a lasting impact in this space, a sentiment well captured by Dalteco:

2. Risk to earn. It’s clear a crypto audience wants to be degenerate and what hasn’t been cracked is how to have outsized rewards + sustainable economics. Usually success is just hype + ponzinomics but I’m very bullish on unique forms of gambling within crypto games that have the right mix of luck, strategy, and skill. Too much of any makes it boring or not worth it. I think cambria is the only game where that’s actually happening and the core of the game is about risking something to make more.

— Dalteco

Risks

In my view, Cambria’s biggest risk lies in its strategy to break into a more Web2-oriented audience, particularly those familiar with Runescape. This highlights the ongoing debate between Path 1 (mainstream-oriented games with blockchain abstraction) and Path 2 (crypto-native games). The hybrid route in between doesn’t seem viable yet. On the Path 1 side, it’s incredibly difficult to compete with a legacy MMO like OSRS. Cambria’s real strength lies in Path 2, a crypto-native approach, where onchain risk and a speculative metagame create a playground for degens.

This means betting on Cambria is a bet on its ability to continue growing its influence within the crypto space, and on the expansion of crypto-native gamers over the next few years. That said, it’s also possible that Cambria could sustain a smaller, high-spending player base; a couple thousand dedicated players could provide a sustainable, profitable model.

Being an onchain ESCROW platform carries inherent risks, as we highlighted earlier with the Duel Arena: “Scrambling to handle the $100M+ in game volume that followed (with no major security incidents) was our trial by fire.” As stakes increase in both the Duel Arena and Cambria’s seasonal prize pools, so does the potential appeal for malicious behavior and security incidents. However, the team has demonstrated that its systems are battle-tested, having successfully handled significant volume without major issues thus far.

The third risk, one that applies not only to Cambria but to any crypto game planning to launch a token, is the current market sentiment around token launches. In today’s environment, with a lack of buyer demand, significant innovation in your token launch model is necessary, whether it’s through go-to-market strategies, distribution models, or a well-thought-out game economy.

Summarized

Pros:

Community:

Built a strong core user base of crypto-native, degen, and OSRS-aligned players.

Familiar gameplay:

High-risk MMO with actual financial stakes that builds on familiar behaviors (OSRS gameplay and grey markets).

Multi-layered meta:

Offers both passive (Paymaster) and active (Viceroy) roles, expanding appeal and strategy. Paymasters introduce a passive participation layer through crypto instead of playing and or managing.

Proven product:

$100M+ Arena volume, $1.3M+ in fees, product-market fit with real spenders.

Economic depth:

In-game systems (durability, stress, guilds, inventory weight, outlaw status) encourage constant decision-making and act as currency and item sinks.

Founder Engagement:

BEN.ZZZ is active, trusted, and driving community trust (despite being undoxxed).

Iterative:

DevFast cycle of idea > test > refine. Feedback-driven and nimble.

Chain flexibility:

Chain-agnostic mindset allows Cambria to chase incentives, players, and liquidity.

NFT utility:

Cores, Companions, Founders: each NFT has meaningful in-game use and compounding benefits.

Creator ready

Abstract streaming provides a strong avenue for the game to grow mindshare among crypto natives.

Cons:

Growth strategy:

Cambria’s main risk lies in its attempt to attract a Web2 audience (especially Runescape players), which faces challenges competing with legacy MMOs like OSRS. Its strength, however, lies in its crypto-native approach (Path 2).

Chain-hopping Risk:

May alienate chain-native audiences (e.g., Ronin evangelists) with too much migration.

Audience concentration:

The audience is currently concentrated with a small base of high spenders, but the game needs a more balanced player base to function optimally.

Onboarding Barrier:

Still requires crypto wallets, ETH/RON, and some understanding of blockchain and Web3.